Stader (SD) has doubled in value as a result of Coinbase’s recent announcement that it will be included in its listing plan.

Coinbase, a prominent player in the cryptocurrency exchange market, has recently disclosed its intention to add Stader (SD) to its coin listing roadmap.

This information has generated considerable excitement within the crypto community, highlighting the significant influence that listings on major exchanges can have on digital assets.

The announcement has resulted in a precipitous increase in Stader’s price and visibility, underscoring the interconnectedness of cryptocurrency valuations and exchange listings.

Stader’s Price Surge and Market Performance

The cryptocurrency exchange giant Coinbase has announced the inclusion of Stader (SD) in its coin listing roadmap, which has resulted in a significant increase in the token’s value.

Stader (SD) is the primary cryptocurrency of the Stader Labs platform, and it is used for transaction payments and governance within the ecosystem.

Stader (SD) encountered a remarkable price surge following Coinbase’s announcement.

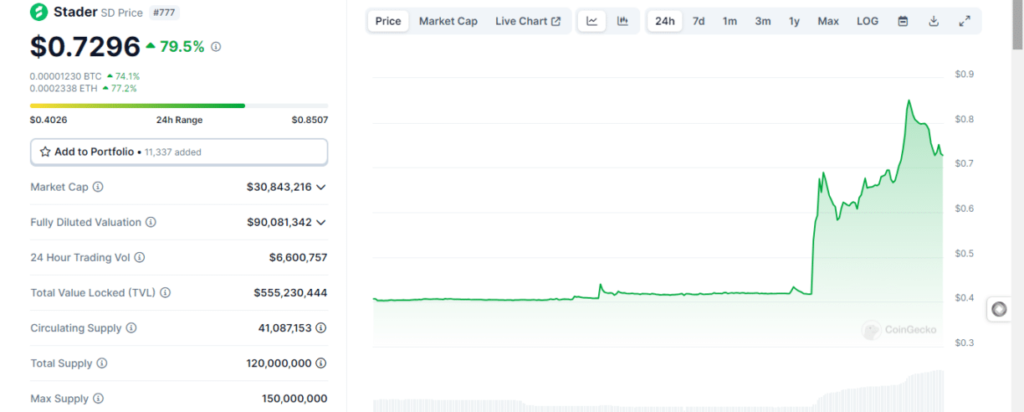

The token’s value increased by over twofold, reaching a peak of $0.8507 before ultimately stabilizing at $0.7296.

Stader maintained an impressive 79.46% increase over a 24-hour period, despite the slightly lower price.

The token demonstrated strength in its weekly performance, with a 15.38% price appreciation over the past seven days.

Meanwhile, Stader experienced an increase in trading activity as a result of the news, with its 24-hour trading volume reaching $6.6 million.

Stader’s market capitalization is $30,843,216, with a circulating supply of 41 million SD tokens.

These figures reflect the substantial influence of Coinbase’s announcement on Stader’s market performance and investor interest.

Coinbase’s Growing Influence and Partnerships

Coinbase’s influence in the cryptocurrency space extends beyond token listings.

The U.S. Marshals Service (USMS) has awarded the corporation a $32.5 million contract for the custody and management of large-cap digital assets.

This partnership represents a substantial step in the government’s adoption of blockchain technology for asset management, signaling growing trust in digital currencies.

Additionally, VanEck’s HODL Bitcoin ETF now includes Coinbase as an additional custodian.

This agreement, announced on June 28, outlined specific terms for securing the ETF issuer’s Bitcoin holdings.

This appointment further enhances Coinbase’s impressive portfolio, as the company currently serves as custodian for eight other Spot Bitcoin ETFs, including those from industry leaders such as BlackRock, Bitwise, and Grayscale.

These developments further solidify Coinbase’s status as a trusted and influential participant in the cryptocurrency ecosystem.