To increase the platform’s liquidity, US-based cryptocurrency exchange Coinbase has eliminated 80 non-USD trading pairs.

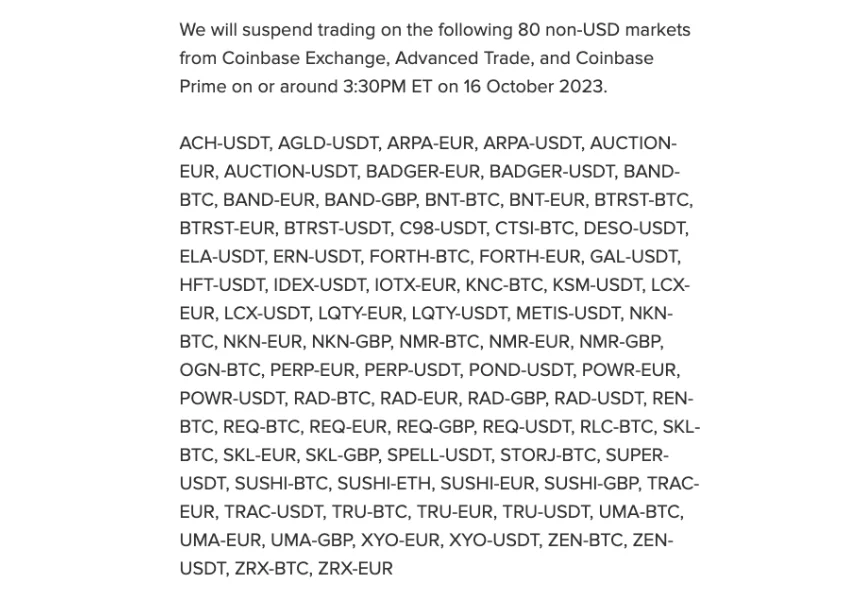

Coinbase has suspended 80 non-USD trading pairings, which include cryptocurrencies such as Bitcoin, stablecoins such as Tether, and fiat currencies such as the euro.

Coinbase announced the news on October 16 and stated that removing the trading pairings aims to improve “overall market health and consolidate liquidity.”

At 19:30 UTC on October 16, the trading pairs were removed from the Coinbase exchange and other platforms, including Advanced Trade and Coinbase Prime.

The latest removals of trading pairs on Coinbase are consistent with the exchange’s early-October announcement that it would suspend the markets. Coinbase emphasized that users of afflicted platforms can continue to trade on its “more liquid USD order books” using their USD Coin balances.

“Please note that these markets represent a negligible portion of Coinbase Exchange’s total trading volume,” the exchange stated.

Coinbase has temporarily suspended trading pairs on its platforms to increase liquidity. In mid-September, the exchange eliminated an additional 41 non-USD markets for the same reasons.

While Coinbase removed multiple USDT-containing trading pairs, none of the suspended markets included USDC, a stablecoin co-developed by Coinbase and Circle.

Coinbase’s ongoing efforts to boost liquidity coincide with the exchange’s plummeting trading volume this year. According to the data provider for the cryptocurrency market, CCData, Coinbase’s spot trading volumes for the third quarter of 2022 fell by 52%.

This year, the market share dominance of other main cryptocurrency exchanges, including Binance, has also decreased. According to CCData, Binance’s spot market share decreased for the seventh consecutive month in September 2023, falling from 55% at the beginning of 2023 to 34% in September 2023.