Coinbase has reportedly launched a crypto lending service for institutional investors in the United States to capitalize on the crypto lending market’s enormous failures.

Bloomberg reported on September 5 that Coinbase has discreetly launched an institutional-grade crypto lending platform, Coinbase Prime, for U.S. investors. Coinbase Prime is a prime brokerage platform that allows institutions to execute transactions and store assets.

“With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption,” the company reportedly said.

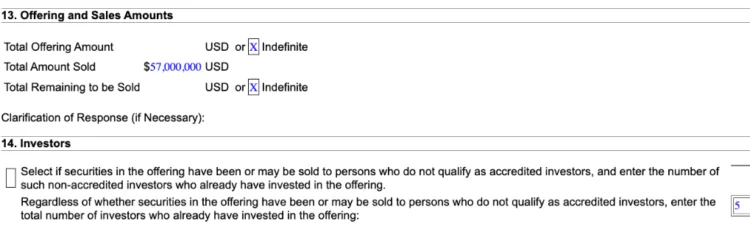

Since the first transaction on August 28, Coinbase customers have already invested $57 million in the lending program, according to a filing with the U.S. Securities and Exchange Commission. As of September 1, the offering had attracted five investors.

Coinbase’s new crypto lending product follows the May 2023 cessation of new loan issuance on Coinbase Borrow. The program will enable users to obtain up to $1 million in Bitcoin collateral. The new institutional program is administered by Coinbase Credit, the same organization that oversees Coinbase Borrow.

The news comes months after the U.S. SEC charged Coinbase with allegedly offering and selling unregistered securities in connection with its crypto starking services, which enable users to receive yields in exchange for giving their crypto to the platform. The exchange refuted the SEC’s allegations, contending that its staking services are not securities.

Eventually, Coinbase was forced to suspend its staking program in California, New Jersey, South Carolina, and Wisconsin as the proceedings continued.

Major companies like BlockFi, Celsius, and Genesis Global went insolvent due to a lack of liquidity caused by the bear market of 2022 in the crypto lending industry.

Some crypto enthusiasts have stated that the crypto lending industry must learn from past failures and address issues involving short-term assets and liabilities.