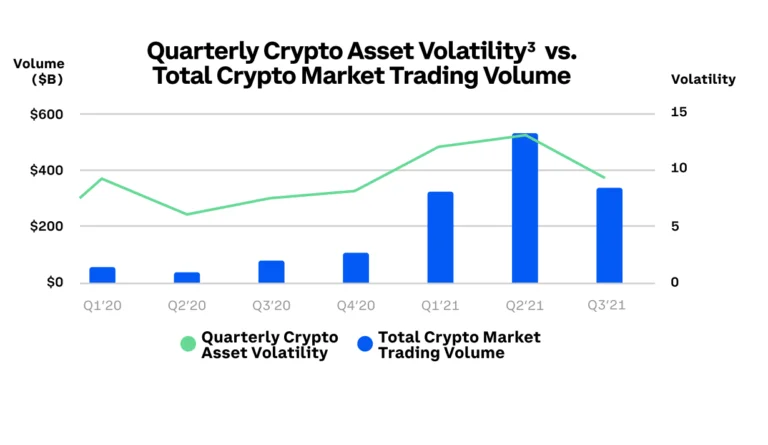

Coinbase, the biggest US crypto exchange reported a fall in both retail and institutional trading volumes of $1.2 billion in net revenue in Q3 due to lower market volatility

Metrics Of Importance

Bitcoin (BTC) and Ethereum (ETH) accounted for 41% of Coinbase’s overall trading volume in the third quarter, down from 50% in the second quarter.

In terms of transaction income, their share dropped from 52 percent to 43 percent.

Quarter-to-quarter, Bitcoin trading volume fell from 24 percent to 19 percent, while Ethereum trading volume fell from 26 percent to 22 percent.

In Q3, “other crypto assets” accounted for a larger share of the crypto exchange’s total trading volume than in the previous quarter, increasing to 59 percent from 50 percent, thanks to expedited listings.”

Our policy of listing all legal assets helps give our clients more and deepen their participation with the cryptoeconomy,” Coinbase explained in response to the launch of 30 new trading assets and 19 new custody assets in Q3.

‘Other crypto assets’ contributed for 57 percent of overall transaction income, up 9 percent from the previous quarter.

In the third quarter, the exchange reported retail trading volume of $93 billion (28 percent) and institutional trading volume of $234 billion (72 percent).

According to the research, Coinbase’s total trade volume fell by 29% in Q3 from $462 billion the previous quarter.

The fall in retail and institutional trading volumes was attributed to “reduced volatility,” according to the exchange.

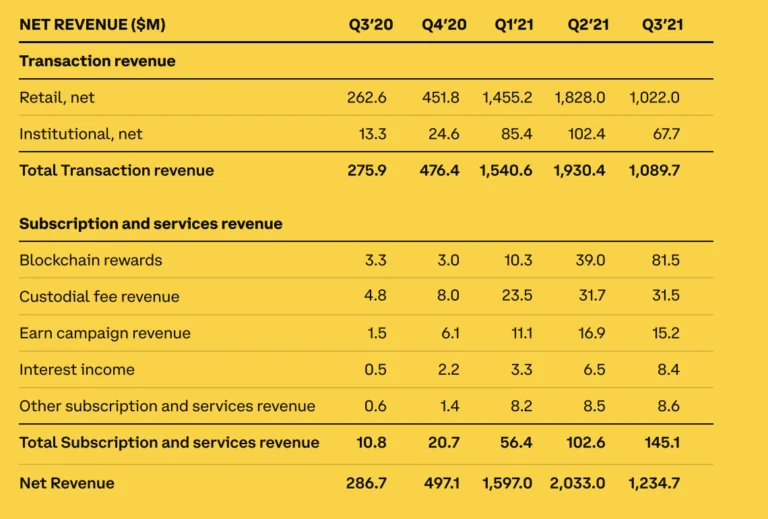

Revenue (Net)

For the third quarter, the exchange reported total net revenue of $1,2 billion. $1 billion in transaction income was generated, with the remaining $145 million coming from subscriptions and services.

According to the data, retail sales accounted for the largest $1 billion portion of revenue, down 44 percent from the previous quarter. In the meantime, revenue from institutional transactions fell 34% in Q3, to $67,7 million.

Coinbase’s’subscription and services revenue’ has increased. The exchange recorded $145 million in revenue, up 41% from the previous quarter.

‘Blockchain incentives revenue,’ the majority of which is made up of staking revenue, contributed significantly to the growth.

“Growth was mostly driven by staking, particularly ETH2, which now accounts for the bulk of our staked assets,” the paper continued. In the third quarter, blockchain rewards revenue was $81,5 million, up 109 percent from the previous quarter.”

Coinbase is performing admirably. “They produced $600 million in EBITDA last quarter, and it’s likely to be greater next quarter,” said Sam Bankman-Fried, who discussed some of the report’s highlights on Twitter.

Coinbase’s spending piqued the curiosity of the CEO of a competitive exchange, FTX.