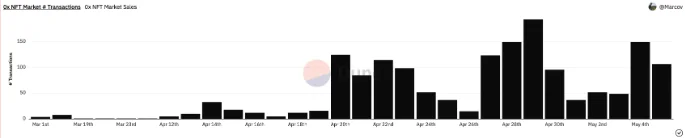

On May 4, Coinbase cryptocurrency exchange opened its beta non-fungible token (NFT) marketplace to the public, with on-chain statistics revealing a maximum of 150 total transactions and $75,000 in USD volume.

The transactions gathered by Dune Analytics represent the entire amount of money exchanged over the 0x Protocol, the technology that powers Coinbase’s marketplace. While not all transactions will be through Coinbase, the company has yet to identify any other partners other than Coinbase since announcing its support for NFTs in January.

The figure is insignificant in comparison to the expectations raised by the marketplace’s waitlist. Before it went into beta testing on April 20, more than 8.4 million email addresses joined up for the waitlist, with only a chosen few able to register profiles to purchase and sell NFTs.

Only about 1,200 total users had transacted on the platform as of May 5, accounting for only 0.014 percent of the waitlist.

The USD market volume numbers are also off; on May 4, just over $74,700 in volume was transacted on Coinbase’s new marketplace. While this may satisfy detractors who claim the NFT business is in freefall, the largest NFT market, OpenSea, saw $1.18 billion in transaction volume on the same day.

Coinbase launched the NFT platform queue about seven months ago, in mid-October 2021, with some Twitter users claiming that the launch took too long to open to the public, despite the fact that rival sites like OpenSea and LooksRare were already listing popular collections.

According to some users, the marketplace in its current form does not separate itself from its competitors because it requires a self-custody wallet and gas fees. Coinbase has plans to amend this in the future, as part of its January collaboration announcement with Mastercard, which will allow first-time customers to acquire NFTs with a credit card.

Coinbase’s stock price is down 68 percent from an all-time high of $357 on November 10 to a low of $112 on April 29. The low user counts for its marketplace come more than a week before a Q1 results call on May 13.