Since the U.S. Securities and Exchange Commission (SEC) filed a complaint against Coinbase for allegedly offering unregistered securities, Coinbase shares have appreciated more than 50%.

Despite a securities violation litigation filed against the Coinbase cryptocurrency exchange in the United States, the company’s stock has risen recently.

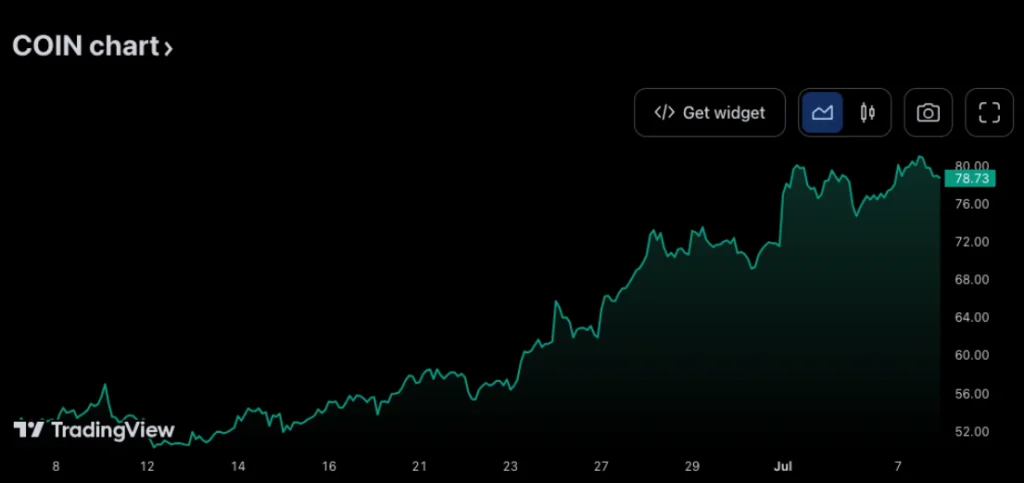

According to data from TradingView, Coinbase’s stock price increased by 51% from approximately $52 on June 6 to $78.7 on July 7. In addition, the stock has gained about 133% over the past six months, compared to roughly 50% year-over-year.

Some major Coinbase shareholders have continued selling shares despite the company’s growth.

Several senior Coinbase executives, including CEO Brian Armstrong, sold approximately $6.9 million worth of shares on July 6.

The transactions included a 4,580 sale by Coinbase board member Gokul Rajaram, a 1,818 sale by chief legal officer Paul Grewal, and a 7,335 sale by chief accounting officer Jennifer Jones, according to SEC filings.

Jones sold 74,375 Coinbase shares on June 29 for $5.2 million.

While Coinbase executives have regularly sold their shares, some significant investors remain.

According to the company’s portfolio updates, ARK Invest has not sold any of its holdings since purchasing an additional 400,000 Coinbase stock in early June. This is consistent with Wood’s view that the price of Coinbase shares would rise as Bitcoin’s price increases.

On June 19, the CEO of ARK Invest reaffirmed her belief that Bitcoin would reach $1 million per coin one day.