Coinbase predicts that the proceeds from Genesis’ GBTC sell-off will remain within the cryptocurrency ecosystem, Amid Price Concerns.

Blockchain-based currency exchange Authorizing insolvent cryptocurrency lending company Genesis to sell its shares in Grayscale Bitcoin Trust (GBTC), according to Coinbase, will not disrupt the cryptocurrency market. It argued that most funds would return to the cryptocurrency ecosystem, giving the market no discernible effect.

On February 14, a bankruptcy judge authorized Genesis to liquidate approximately $1.3 billion worth of GBTC to reimburse creditors.

However, since January 10, when Grayscale Investments received approval to convert GBTC into a spot Bitcoin exchange-traded fund (ETF), GBTC has undergone outflows in excess of $5 billion.

Concerns have been raised in the cryptocurrency community regarding the potential repercussions of Genesis’ recent authorization to liquidate GBTC shares, which could further depreciate the Bitcoin BTC price.

Coinbase argued in its weekly report that although the destination of the additional GBTC outflows remains ambiguous (whether it be to other spot Bitcoin ETFs or directly into Bitcoin to reimburse creditors), the funds will likely remain within the cryptocurrency ecosystem.

“Our view is that much of these funds will likely remain within the crypto ecosystem, contributing to a neutral overall effect in the market.”

It was specified that Genesis might convert GBTC shares into the underlying Bitcoin asset on behalf of the creditors or sell the shares outright and distribute the funds by the terms of the bankruptcy plan. The confirmation hearing, nevertheless, is planned for February 26.

In addition to 8.7 million Grayscale Ethereum Trust (ETHE) and 3 million Grayscale Ethereum Classic Trust (ETCG), Genesis possesses 35.9 billion GBTC.

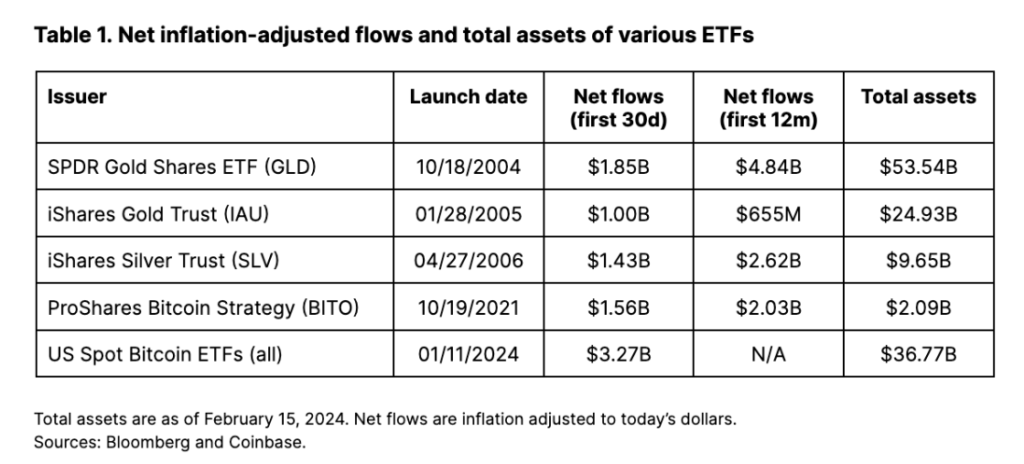

In the meantime, it was emphasized that the net inflows for Bitcoin ETFs during their initial thirty days exceeded those of the SPDR Gold Shares ETF (GLD) offered by State Street in its inaugural month.

Total assets and net inflation-adjusted flows of various ETFs. Sam Callaghan, a senior analyst at Coinbase and a representative of Swan Bitcoin, stated on X (previously Twitter) that Genesis’ GBTC sales will cause some “netting” in the cryptocurrency market. On the other hand, Callaghan stated that the number of creditors who will divest their Bitcoin holdings is uncertain.

8/ So, in total, Genesis will likely be selling 67.1 million shares of GBTC worth nearly $3 billion soon.

Expect the GBTC outflows to increase again when this happens, but remember, this is a one-time selling event. The market will absorb it, and Bitcoin will keep marching on. pic.twitter.com/RXD4UMxN5h

— Sam Callahan (@samcallah) February 13, 2024Jag Kooner, director of derivatives at MeanBitfinex, told reporters that the substantial “discount” provided to GBTC investors in recent weeks was the primary factor in the high volume of share sales.