Core Scientific shares fell over 10% after announcing an increased $400 million convertible senior note offering.

Core Scientific, a Bitcoin miner, experienced a slight decline in its stock price of just over 10% subsequent to its announcement that it would be offering up to $400 million in convertible senior notes to investors. This amount represents an increase from the initial $350 million announced the previous day.

A senior convertible note is a type of debt security that can be converted into equity at a later date and generate interest payments for the investor over time. It constitutes a form of debt for the organization.

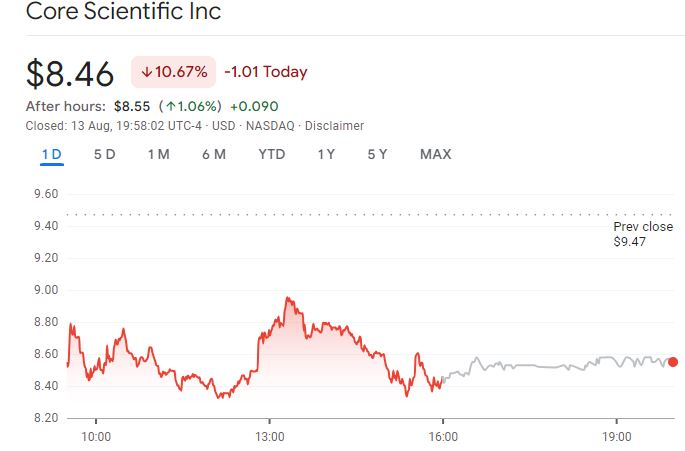

On the Nasdaq, Core Scientific’s stock has declined by 10% to $8.46 per share. Nevertheless, it experienced a 1% increase in value to $8.55 after hours.

The miner disclosed in its August 14 media release that the $400 million in notes would be distributed exclusively to qualified institutional purchasers in a private offering.

Investors have the option to either retain the senior, unsecured debt until it matures or convert it into shares. The company stated that interest will be distributed semi-annually.

The offering may also include a provision that allows purchasers to purchase an additional $60 million in notes that will mature on Sept. 1, 2029, unless they have been previously converted, redeemed, or repurchased. Settlement is scheduled for August 19.

Core Scientific has stated that the net proceeds will be used to fully repay all outstanding loans under its credit and guaranty agreement, which was entered into on January 23, 2024, and to redeem all of its outstanding senior secured notes due in 2028.

“Core Scientific plans to allocate the remaining net proceeds from the offering to general corporate purposes, such as working capital, operating expenses, capital expenditures, acquisitions of complementary businesses, or other repurchases of its securities,” the company stated.

It is anticipated that the miner will raise a total of $386.6 million, or $445.0 million if investors elect to purchase additional notes.

Pushing Through Bankruptcy Difficulties

Core Scientific emerged from bankruptcy in January after the bankruptcy court for the Southern District of Texas validated its reorganization plan. This allowed the company to eliminate $400 million in debt and continue operations.

In December 2022, Core Scientific filed for insolvency due to a complex combination of factors, including the crypto winter, increasing energy prices, increased mining difficulty, and bad debt lent to cryptocurrency firm Celsius.

According to its financial report on August 7, the miner experienced a net loss of $804.9 million in the second quarter of 2024, which is in contrast to a net loss of $9.3 million in the same period the previous year.

Nevertheless, the organization maintains an advantageous position. According to Core Scientific, it has mined 5,052 Bitcoins thus far this year, which are currently valued at more than $300 million.