Prior to Tuesday’s increase in the price of Bitcoin, “whales” continued to amass the cryptocurrency to the tune of $388,3 million.

After Tuesday, Grayscale’s victory over the US SEC, the Bitcoin price quickly recovered, surging past $27,500. However, since then, the BTC price has experienced a partial retracement and is currently trading at $27,240, down 0.79 percent.

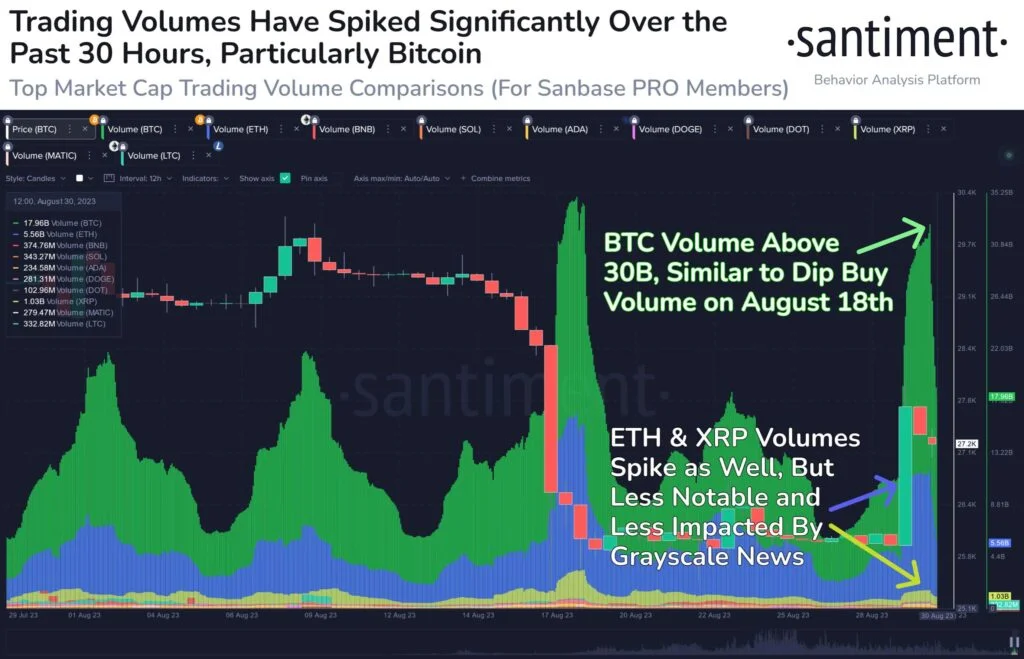

According to on-chain data, trading volumes have remained stable a day after Tuesday’s boost. Santiment, a provider of on-chain data, explains that trading activity remains robust despite the recent price increases in the cryptocurrency market.

There has been a notable resurgence in investor interest in Bitcoin. The market should stabilize if Bitcoin continues to trade between $27,000 and $28,000. However, volatility is likely to increase if the price deviates outside of this range.

Large cryptocurrency holders, also known as whales and sharks, may have had information about the outcome of the Grayscale and SEC case the day before the news addresses holding between 10,000 and 10,000 Bitcoin (BTC) acquired approximately $388.3 million worth of Bitcoin.

Bitcoin has been weakening over the past few weeks on the technical indicators. Earlier this month, the BTC price fell below its 200-day moving average and has failed to recover above these levels.

Alternatively, if the BTC price fails to sustain below $25,000, it risks sliding to $20,000. Future developments to keep an eye on include the potential Fed tightening in the face of persistent inflation.

Mike McGlone, a senior commodity strategist at Bloomberg, explains, “Bitcoin $30,000 May Be New $12,000, With Fed-Tightening Overhang – The inevitable approval of Bitcoin (ETFs) in the US is moving closer, but the elephant in the room for all risk assets remains – the Fed is still tightening despite the tilt toward economic contraction”.

It will be fascinating to see if Bitcoin maintains a price of around $27,000 in the future or if the current recovery is just another dead cat bounce.