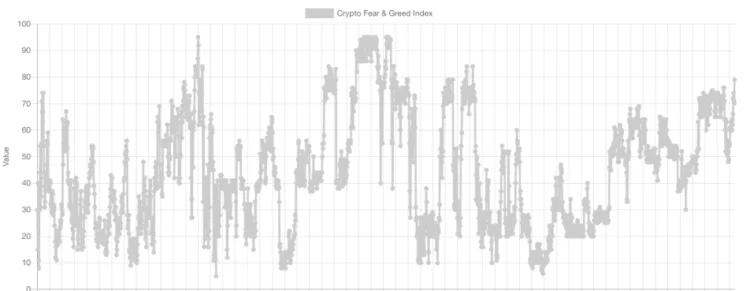

Crypto Fear and Greed Index has reached an all-time high score of 79, levels not seen since Bitcoin’s all-time highs in November 2021.

The Crypto Fear and Greed Index peaked at 79 on February 13, according to data from the website Alternative.me. This is the highest level since mid-November 2021 when the Bitcoin price peaked at $69,000.

The Crypto Fear and Greed Index witnessed its most recent surge of avarice shortly after Bitcoin surpassed $50,000 on February 12. Since the beginning of the year, the value of the cryptocurrency has increased by approximately 13%, according to data from CoinGecko. This has been the case for the past few months.

As the Crypto Fear and Greed Index reaches 79 points for the first time in over two years, it enters the “extreme greed” zone when the index’s value surpasses 74.

In anticipation of the introduction of spot Bitcoin exchange-traded funds (ETFs) in the United States, the Crypto Fear and Greed Index reached its all-time high of 76 on January 11.

A month after the launch of U.S.-based spot Bitcoin ETFs, the ongoing Bitcoin rally and the new surge of greed indicate that short-term selling associated with the ETF approval news has concluded.

Cathie Wood, chief executive officer of ARK Invest, predicted at the end of 2023 that certain investors would “sell the news” of the imminent approval of spot Bitcoin ETFs.

“That would be rather temporary,” Wood explained. “We anticipate that the SEC will grant institutional investors permission to invest in the spot Bitcoin ETF shortly.”

Google Trends, surveys, market momentum, market dominance, social media, and market volatility are some indicators utilized in calculating the Crypto Fear and Greed Index, which influences the behavior of traders and investors. The index constitutes 25% of market momentum, 25% of market volatility, and 15% of social media trends and other indicators.

Despite the Crypto Fear and Greed Index offering valuable insights into the crypto market’s condition, individual traders or investors should conduct further research to identify the most appropriate tools for their specific investment objectives.