Crypto liquidations have ramped up following the recent crypto market crash as liquidations took a decline

Increase In Crypto Liquidations

Following the market crisis, crypto liquidations have increased. Even with the rebound, there had been an increase in liquidations because short calls had also suffered. The market has started to re-establish some sort of balance since the recovery started moving during the past week, and as a result, the liquidations have started to level off.

Even while they still occur, they have started to slow down. At the height of the market meltdown, it had dropped from over $1 billion. It has gradually but steadily been restored to normal levels.

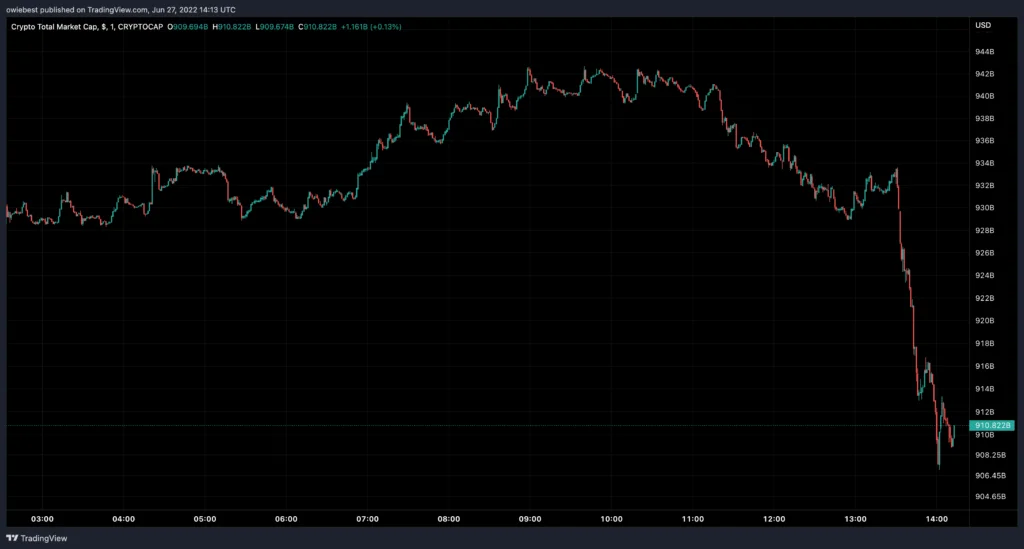

This is clear from the liquidations over the previous 24 hours, which have remained consistent at about $150 million. Given that the market had a sharp decline in the early hours of Monday morning, it has tended to favor long traders.

Most Liquidated Assets

As would be predicted, bitcoin and Ethereum head the list of digital assets that have been liquidated the most during this time. In the last 24 hours, liquidations of Bitcoin alone have totaled more than $43 million, while those of Ethereum have reached more than 24K ETH, totaling more than $29 million.

However, almost 74,000 traders have been liquidated over this time, with long transactions accounting for 69.73 percent. The exchanges OKEx and Binance have experienced the most liquidations. However, the Bitmex exchange’s XBTUSD trade, worth $2.48 million, represented the greatest single liquidation for the previous day.