The crypto market faces uncertainty following the EU Parliament election results due to the volatile trading conditions caused by political shifts.

The crypto market is experiencing increased volatility due to recent macroeconomic and political events. The most recent EU Parliament election results have substantially impacted investor sentiment, further complicating an intricate landscape.

In the meantime, investors are seeking clarification on the future of digital asset regulations and market stability in light of the political transition in Europe and the divergent economic indicators of major economies.

The crypto market is experiencing volatile trading in response to political shifts

The recent elections in the European Union have yielded substantial gains for far-right parties, which has significantly impacted the crypto market and the political dynamics in Germany, France, and Austria. Marine Le Pen’s National Rally emerged victorious in France, defeating President Emmanuel Macron’s Renaissance party. This outcome has prompted Macron to announce the demand for immediate legislative elections.

Furthermore, the right-wing’s success indicates a more generalized trend of anti-establishment sentiment in the European crypto market. Consequently, the far-right surge poses a significant challenge to mainstream parties despite their continued control of the 705-member European Parliament.

Meanwhile, this viewpoint is consistent with the general concern that regulatory environments may become more restrictive under right-leaning governance. On the other hand, adopting supportive regulations, such as the Markets in Crypto-Assets (MiCA) framework, could be hastened by a more crypto-friendly posture from mainstream or left-leaning parties.

Economic Factors Influencing Market Attitude

In addition to political developments, the latest economic indicators have further complicated the crypto market’s outlook. The European Central Bank (ECB) announced a 25 basis point rate cut last week, initially fostering investors’ optimism. This action is a potential catalyst for economic development and a supportive measure for risk assets, such as cryptocurrencies.

This political shift has significant implications for the crypto market, which is worth noting. According to recent reports, Jag Kooner, Head of Derivatives at Bitfinex, has expressed apprehensions that a right-wing slant could lead to more stringent cryptocurrency controls.

Nevertheless, the mood abruptly changed on Friday due to the release of U.S. employment data that was stronger than anticipated. The robust employment figures diminished the Federal Reserve’s prospects for a comparable rate-cut strategy.

The crypto market experienced an adverse reaction, retreating as investors reevaluated their expectations for monetary policy in the United States. The confidence of crypto investors is impacted by the contrasting posture between European rate cuts and a potentially more hawkish stance from the Federal Reserve, which has introduced additional uncertainty into the market.

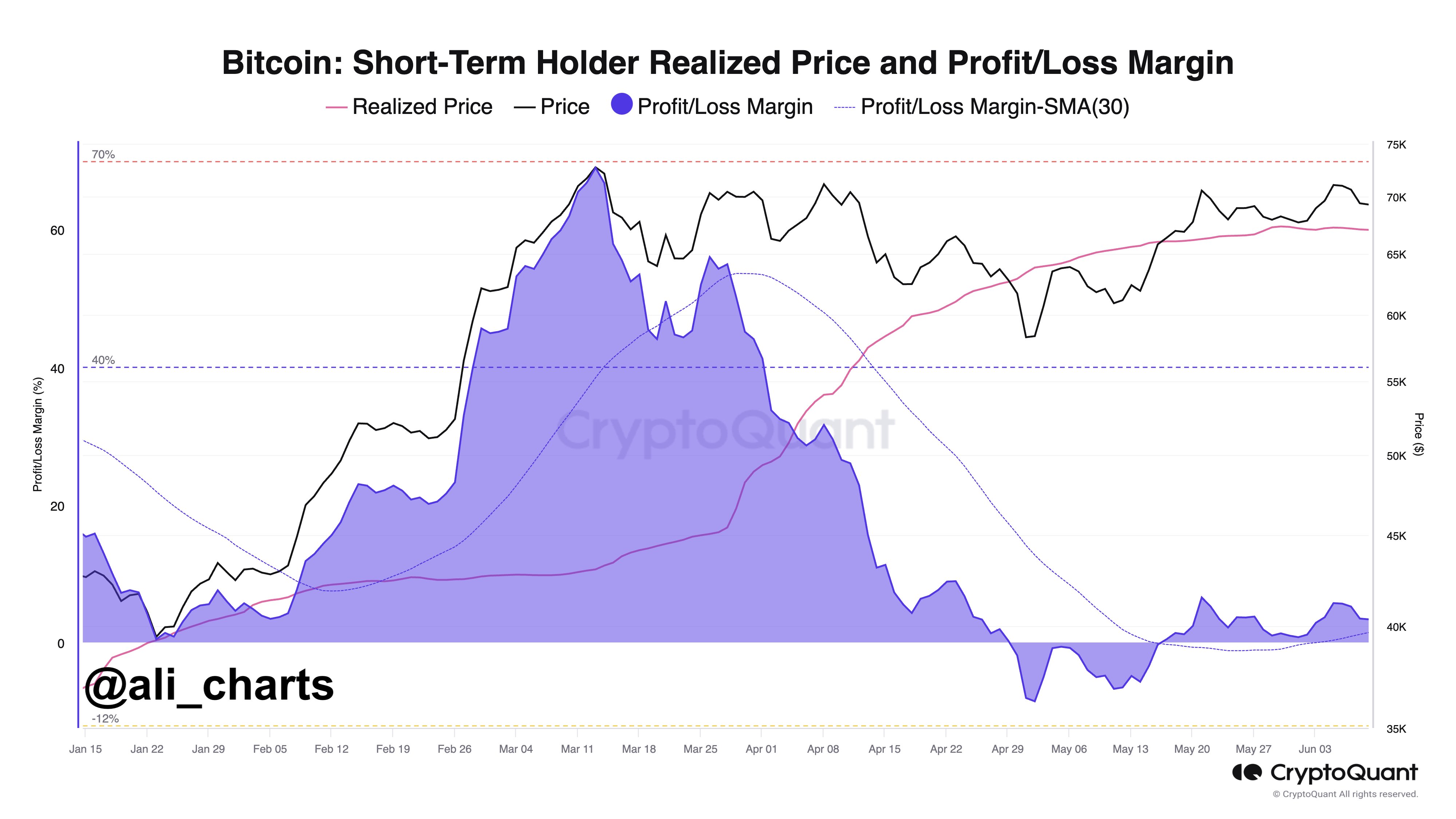

Despite this, the market analysts maintained optimism regarding the cryptocurrency market’s future. Over the past few days, there has been a substantial increase in institutional interest in the U.S. Spot Bitcoin ETF. In addition, crypto analyst Ali Martinez has dismissed the concerns regarding the crypto market’s selloff.

Ali Martinez recently stated in a post on X that the short-term holders of Bitcoin are currently experiencing a 3.35% profit, which indicates a “minimal risk” of a further BTC selloff. In the interim, the crypto market valuation had decreased by 0.21% to $2.53 trillion at the time of writing.