The crypto market experienced a significant decline on Friday, which caused major cryptocurrencies to lose crucial support and drop to new monthly lows with BTC price crashing below $22,000.

Last week, Bitcoin (BTC), which was trying to overcome the $25,000 resistance, dropped under $22,000, setting a new two-week low of $21,747. The second-largest cryptocurrency, Ether (ETH), climbed beyond $2,000 in the run-up to The Merge but has since fallen by 6% to a new weekly low of $1,726.

157,098 traders were liquidated in the last 24 hours as a result of the flash crash, which came after weeks of bullish momentum, liquidating almost $551 million. According to data from Coinglass, dealers of Bitcoin and Ethereum collectively lost approximately $203 million in liquidations.

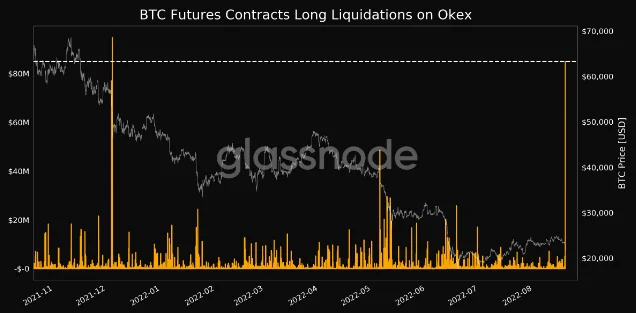

The accompanying liquidation chart shows that long positions have been liquidated in greater numbers than short ones, showing that market sentiment was very bullish before to the flash crash. Compared to $398 million in long bets, only $41 million worth of short positions were liquidated.

On OKX (previously known as Okex), BTC futures long liquidations surpassed the previous record of $48,630,183.66 on May 5, 2022, reaching an 8-month high of $84,934,697.05 instead.

The Fed’s anticipated interest rate hike in September is being blamed for the abrupt decline in the cryptocurrency market. Consumer price index (CPI) numbers for August were lower than anticipated, which sparked a bullish spike in both the cryptocurrency and FX markets.

James Bullard, president of the Federal Reserve Bank of St. Louis, stated that he would support a 75 basis point rise. The Fed raising interest rates next month might trigger another downturn.

After an initial price boom, a comparable interest rate increase of 75 basis points in June caused chaos in the cryptocurrency market.