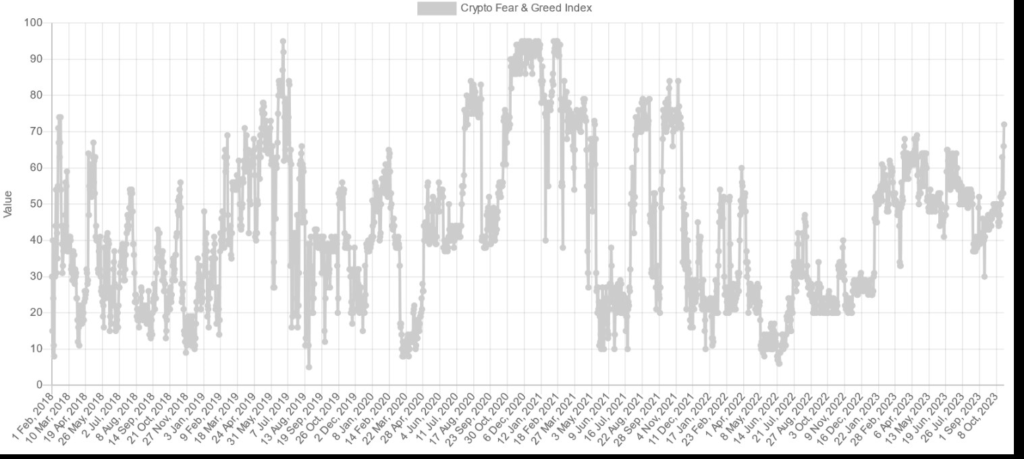

The Crypto Fear & Greed Index has returned to levels not seen since November 2021, at the height of the crypto market rally.

According to the Crypto Fear & Greed Index, Bitcoin market sentiment has returned to levels not seen since its price reached $69,000 in mid-November 2021.

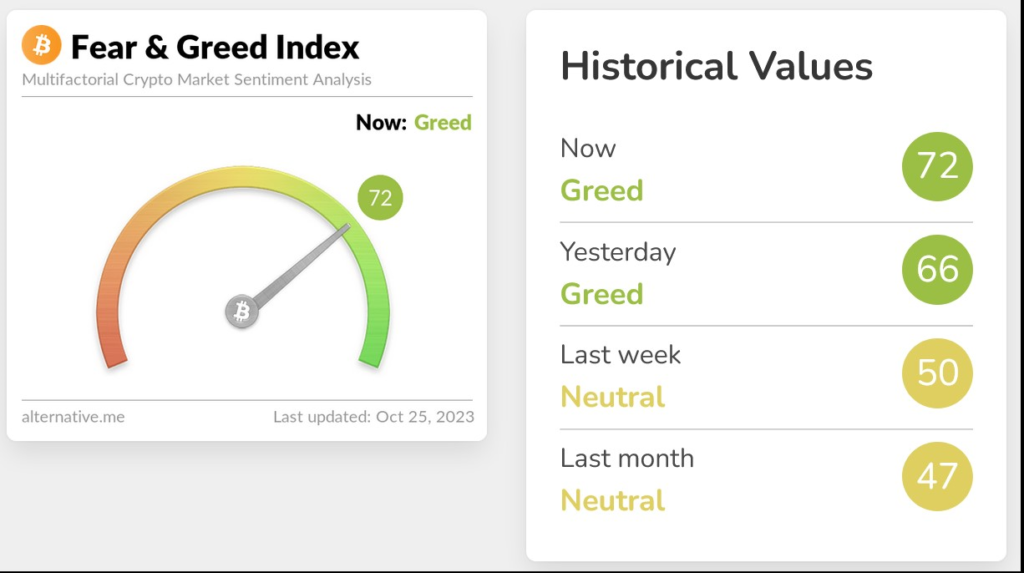

The index’s current score of 72 out of a possible 100 places it in the “greed” category, a six-point increase from October 24 and a 16-point increase from its “neutral” classification of 50 points on October 18.

Following a surge of optimism that BlackRock’s spot Bitcoin exchange-traded fund (ETF) could be inching closer to approval by the United States Securities and Exchange Commission, market sentiment has improved.

On October 24, Bitcoin experienced its largest single-day rally in over a year, with a 14% daily increase as its price surpassed $35,000.

The index compiles and considers information from six market key performance indicators — volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), Bitcoin’s dominance (10%), and trends (10%) — to calculate daily market sentiment

The last time the index reached 72 was on November 14, 2021, just four days after BTC reached its all-time high of $69,044 on November 10, 2021, according to data from CoinGecko. On June 16, 2022, after Do Kwon’s Terra ecosystem collapsed, the index recorded its lowest-ever score of 7.

The aftermath of Terra’s collapse precipitated a cascade of price-depressing effects, ultimately claiming the lives of hedge fund Three Arrows Capital and cryptocurrency lender Voyager Digital, among others.

Following the enthusiasm surrounding spot ETFs, Galaxy Digital, a cryptocurrency investment firm, has predicted that the price of Bitcoin will increase by more than 74% in the first year following approval.