The Judge denied the removal of US sanctions against Tornado Cash by comparing its smart contracts to vending machines.

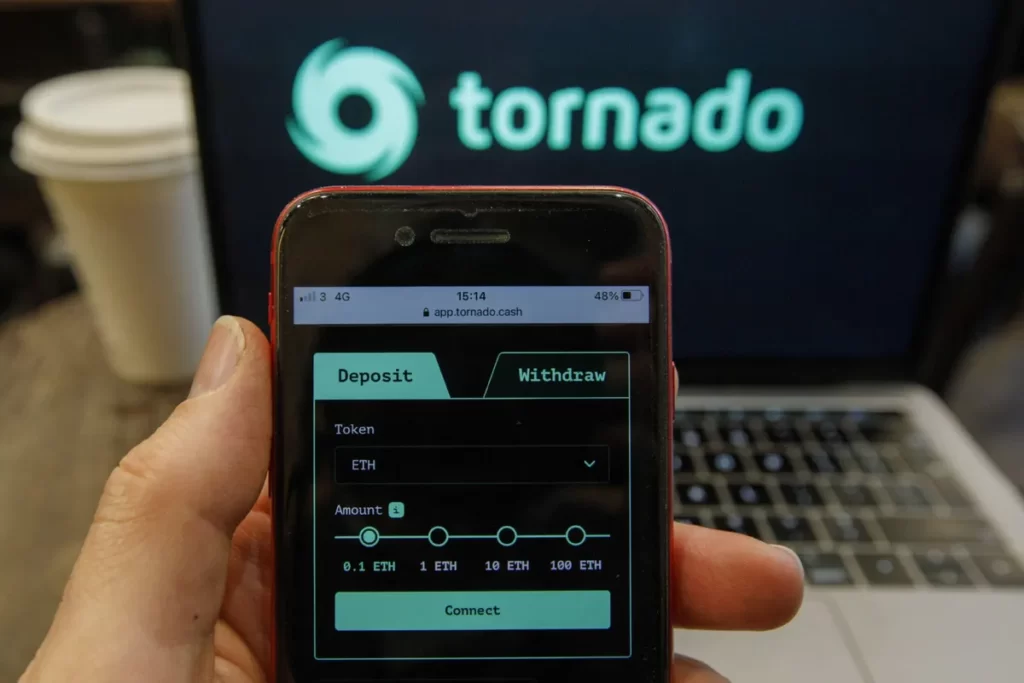

On Thursday, August 17, a federal magistrate denied a motion from crypto participants and giants such as Coinbase, who argued that the U.S. Treasury’s sanctions against the crypto mixing service provider Tornado Cash were excessive.

Six individuals, including two Coinbase employees, were denied summary judgment by Judge Robert Pitman of the U.S. District Court for the Western District of Texas on the grounds that the Treasury exceeded its authority in attempting to prevent financial transactions that benefit foreign terrorists.

Plaintiffs in the lawsuit, who were backed by Coinbase, alleged that the department’s actions affected blameless Americans who used the private service for legal purposes. However, the judge chose to concur with the decisions of the U.S. Treasury.

Cash Tornado Versus U.S. Treasury

A year ago, the Office of Foreign Assets Control (OFAC) of the U.S. Treasury accused Tornado Cash of laundering over $7 billion worth of cryptocurrencies since its founding in 2019. As a result, the agency imposed sanctions on cryptocurrency wallets associated with Tornado Cash and intelligent contract-related protocols.

The digital asset research firm Chainalysis reported 2023 that it had linked nearly $2 billion worth of cryptocurrency misappropriated in 2022 to North Korean hacking groups. Moreover, according to Chainalysis, these organizations relied significantly on Tornado Cash to launder their stolen funds.

The judge compared smart contracts to vending machines in a recent ruling. Judge wrote: “This reinforces the Court’s point. Vending machines are examples of unilateral contracts. And like vending machines, a smart contract is a tool that carries out a particular, predetermined task. The fact that smart contracts do so without additional human intervention, like a vending machine, or that they are immutable, does not affect its status as type of contract and, thus, a type of property within the meaning of the regulation.”