Donald Trump’s crypto-friendly policies could accelerate digital asset adoption in Latin America, where Bitcoin and stablecoins are widely used for inflation protection and remittances.

Crypto Policies to Boost Adoption in Latin America

According to experts, the proliferation of digital assets in Latin America could be accelerated by Donald Trump’s election victory and his pledge to implement crypto-friendly policies. In this region, stablecoins and Bitcoin already function as remittance channels and inflation shields for millions.

The President-elect’s pro-Bitcoin stance is resonating in inflation-hit economies, as regional exchanges are reporting a surge in crypto activity.

The president-elect’s commitment to create a national Bitcoin reserve and reduce regulatory burdens coincides with the emergence of Latin America as a significant growth market, with an annual volume of over $85 billion in crypto transactions, as indicated by Chainalysis data.

Trump’s victory is perceived by regional stakeholders as a potential catalyst for increased institutional adoption and cross-border flows.

“Trump’s second term in the White House could further boost the crypto market, giving room for further appreciation,” Sebastian Serrano, CEO of Argentina-based exchange Ripio, said in statements shared by Cointelegraph. “We are observing a decisive period for Bitcoin and the cryptocurrency market as a whole.”

Countries that are currently experiencing currency instability may find the implications to be especially significant.

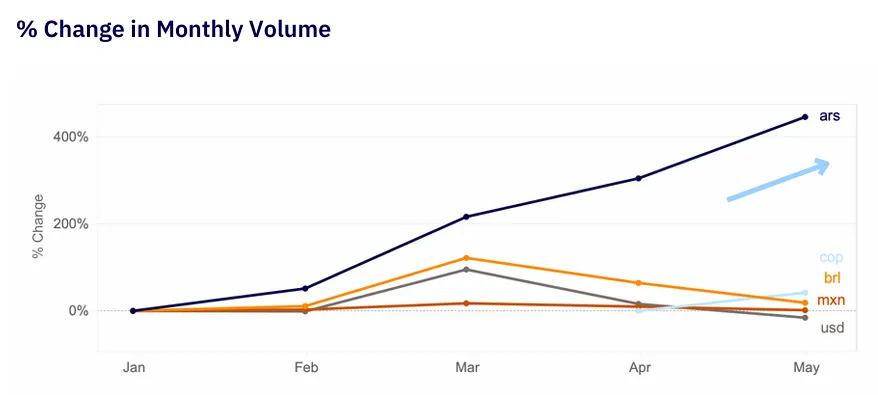

Bitcoin trading volumes experienced a 160% increase in October and more than 400% in 2024 in Argentina, where the poverty rate reached over 53% during Milei’s libertarian administration. This was due to the fact that users were seeking refuge from devaluation. Similar patterns are observed in Venezuela, where over 92% of crypto activity is channeled through centralized exchanges as citizens pursue alternatives to the bolivar.

Cryptocurrency firms in the region are currently preparing for potential expansion. In its initial three months, Lemon Cash, which recently expanded to Peru, processed more than $20 million in local currency transactions.

“Clear U.S. regulations could help us accelerate adoption across more LatAm markets,” said Marcelo Cavazzoli, Lemon’s CEO, in an interview with Decrypt en Español.

“Donald Trump’s victory gave (crypto) an additional boost, as his campaign showed clear support for the sector,” Cavazzoli added, “Trump put forward policies to incentivize Bitcoin mining in the United States, aligning with the growing interest in the crypto market. This was especially reflected in Argentinean and Peruvian users, who began accumulating Bitcoin at the end of October.

Cavazzolli informed Decrypt that the trading volume of Bitcoin in Argentina reached a record high on November 6, and Peru also experienced a 160% increase in trading activity compared to the previous day.

Nevertheless, certain regional players warn that Trump’s campaign promises, while they may have bolstered market sentiment, do not resolve the genuine requirements of the crypto industry and do not address the fundamental changes that are currently confronting LatAM’s crypto ecosystem.

In an interview with Decrypt en Español, Matías Reyes from TruBit exchange stated, “The regulatory shift is beneficial; however, we must still address the fundamental infrastructure challenges.” “Cross-border settlement and banking relationships are crucial for our region.”

Latin America’s distinctive combination of significant remittance flows, challenging monetary conditions, and high crypto awareness positions it to potentially benefit from Trump’s crypto agenda. Institutional interest is increasing as regulatory clarity improves, according to regional exchanges.

“Traditional financial institutions are increasingly contacting us,” stated Hongyi Tang of TruBit. “U.S. policy shifts could accelerate this trend by providing clearer frameworks for banks and payment providers.”

In a region where centralized exchanges manage over 60% of transaction volume, which is considerably higher than the global average of 48%, the potential for new growth could be unlocked by reduced regulatory friction. Brazil, Argentina, and Mexico are currently among the top 20 countries in the world for the adoption of cryptocurrency.

Latin American countries are currently grappling with their own regulatory frameworks, which has raised the possibility of a U.S. administration that is more receptive to Bitcoin.

In 2023, Brazil implemented comprehensive crypto legislation and is anticipated to introduce its blockchain-based CBDC next year, while Argentina’s CNV is in the process of finalizing regulations for virtual asset service providers.

Alfonso Martel Seward of Lemon Cash clarified that regional regulators carefully monitor U.S. policy. “A more accommodating U.S. stance could influence local frameworks, especially around stablecoins and exchange operations.”

The US-Latin America crypto market, which is presently processing approximately $300 million in daily transfers, is at a potential inflection point as Trump prepares to assume office.

It remains to be seen whether Trump’s campaign promises will be translated into policies that are advantageous to regional adoption, a departure from his actions and statements during his initial mandate. However, local stakeholders are cautiously optimistic.