Coinbase has led a coalition of prominent tech companies, advocacy organizations, and crypto firms to form a ‘Tech Against Scams’ partnership to curb industry fraud.

Recently, Match, Kraken, Gemini, Ripple Labs, Meta, and the Global Anti-Scam Organization (GASO) joined Coinbase to announce establishing the “Tech Against Scams” safety and education initiative.

Tech Against Scams endeavours to mitigate the most widespread fraudulent schemes afflicting the sector through public education regarding diverse deceptive schemes and disseminating optimal strategies to prevent oneself from falling prey to them.

Coinbase mentioned “pig butchering” hoaxes in a press release as one of the particular schemes the organization intends to combat.

Long-term pig butchering is a fraudulent scheme in which perpetrators devote considerable time to establishing rapport with their victims to gain their trust and “fatten” them up before taking their hard-earned cash.

Scammers frequently use dating applications to target their victims and employ romance to establish trust. In certain instances, con artists approach potential victims by presenting fraudulent business opportunities and making unfounded assurances.

Coinbase emphasized that these fraudulent activities predate the cryptocurrency industry’s inception and digital technology. They are not exclusive to either sector or technology.

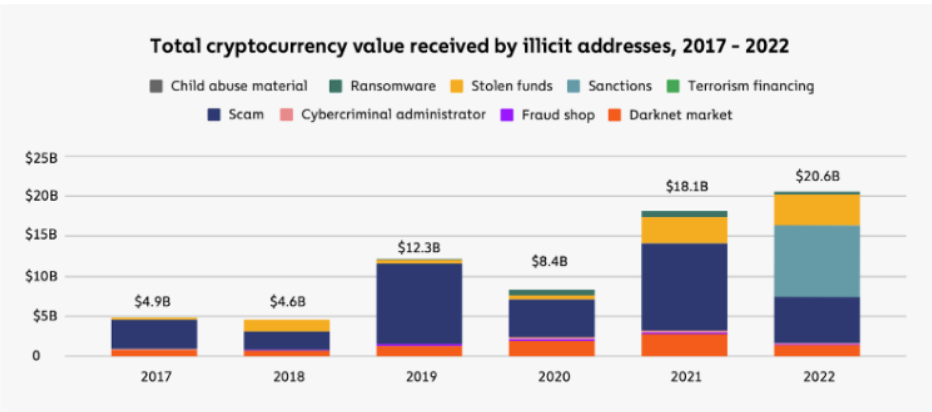

An estimated $5.9 billion was stolen through crypto-related schemes in 2022, according to the most recent Crypto Crime Report from Chainalysis. However, Coinbase forecasts that the total number of illicit transactions represents only 0.34% of all crypto transactions worldwide.

Recently, Reuters reported that U.S. prosecutors have charged two individuals with allegedly executing a pig butchering scheme with a cryptocurrency focus.

In April, U.S. authorities apprehended Yicheng Zhang and Daren Li on suspicion that they were responsible for the $73 million siphon scheme from their victims.

Reportedly, the two individuals funnelled stolen digital assets acquired by promoting fraudulent cryptocurrency investment opportunities through 74 shell corporations to conceal the fraudulent operation.

A bank account affiliated with each shell company ultimately facilitated the transfer of the stolen funds to a bank account in the Bahamas.

The maximum possible sentence for both suspects convicted of money laundering is twenty years in prison.