Grayscale said in recent filings that the three crypto tokens “may be a security based on the facts as they stand right now.”

The U.S. Securities and Exchange Commission (SEC) has asked Grayscale Investments LLC about its “security law analysis” of tokens in some of its less popular crypto trusts.

The investigation, which Grayscale revealed in filings made in June and mid-August that didn’t get much attention, casts a shadow over the trusts’ future at a time when the world’s largest digital asset manager is already dealing with a sharp drop in the value of its assets due to the ongoing crypto winter.

Disclosures are made in filings for trusts that hold the native cryptocurrencies of the Stellar (XLM), Zcash (ZEC), and Horizen (ZEN) blockchains. In the filings, Grayscale said it was “responding” to SEC staff from the Division of Corporate Finance and the Enforcement branch, which has recently stepped up its efforts to police cryptocurrency.

Grayscale didn’t respond right away when asked for a comment.

The SEC’s questions show how uncertain Grayscale’s lineup of crypto trusts that can be bought with brokerage accounts is. It also shows that regulators are getting more and more ready to crack down on tokens that they think should be covered by U.S. securities law.

Grayscale tells traditional investors that crypto trusts are an easy way to buy crypto tokens along with stocks and bonds. Grayscale is a subsidiary of Digital Currency Group, just like CoinDesk. It has billions of dollars worth of assets in these trusts, with the most popular ones being bitcoin (BTC) and ether (ETH).

Only $40 million of Grayscale and roughly $18.7 billion in funds and trusts are held in ZEC, ZEN, and XLM. This makes them small outposts in an empire that used to be much bigger. During the market peak in November of last year, Grayscale was worth about $60 billion. Then, along with the rest of the crypto markets, its value dropped.

Even though these three trusts aren’t very big, the fact that their legal status – whether they are securities or not – is still unclear shows how important Grayscale’s regulatory gamble is. Its trust business is based on the idea that these cryptocurrencies are not securities. In the filings, it says that if it finds out otherwise, it may have to shut down the trusts.

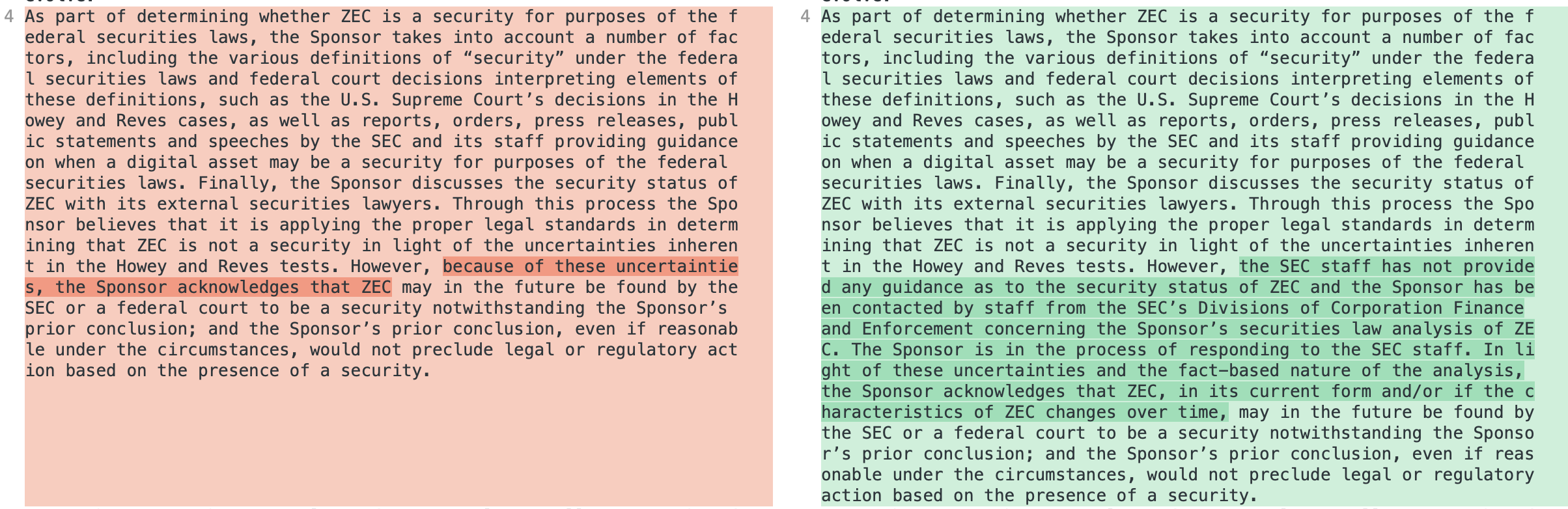

In August, Grayscale said for the first time that ZEC, ZEN, and XLM “may be a security, based on the facts as they exist today.” This was a big change from May and June when the company said that the three could be called securities in the future.

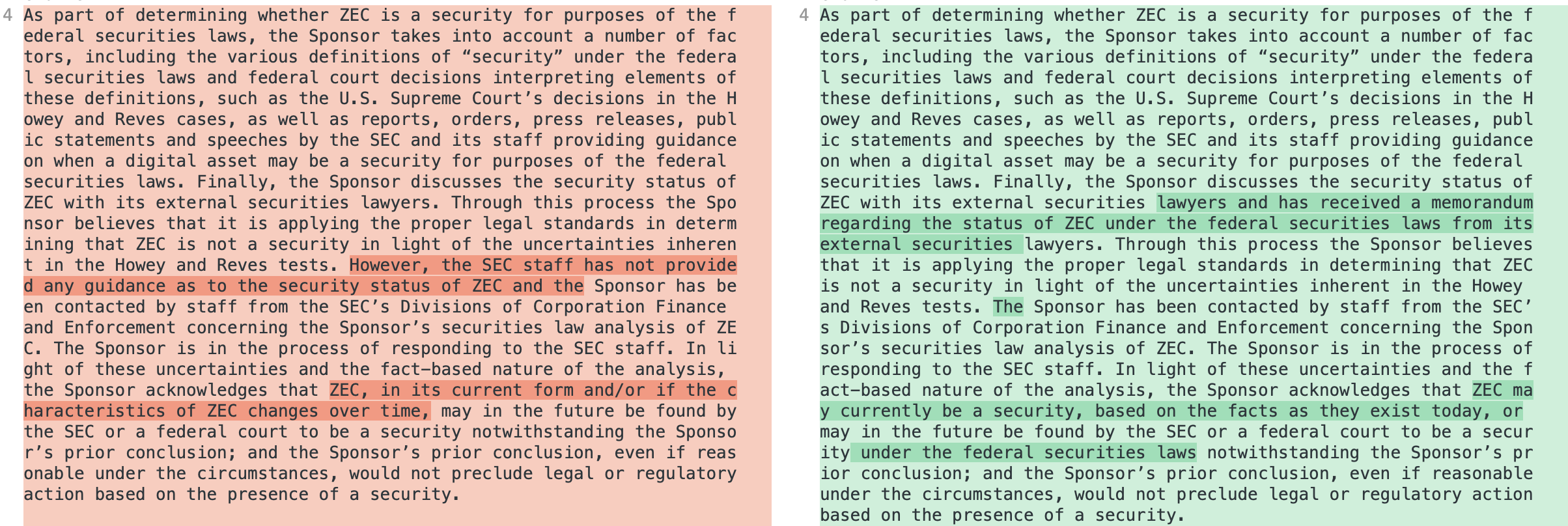

Other changes between Grayscale’s filings in June and August also show that the SEC‘s view of ZEC, ZEN, and XLM is changing quickly.

In the filings from June 28, which are the first time Grayscale talks about the back and forth with regulators, the asset manager says that “SEC staff has not provided any guidance as to the security status of” ZEN, ZEC, and XLM.

This line is not in the documents filed on August 16.

Another thing that was added on August 16 was that Grayscale “has received a memorandum from its external securities lawyers about the status of [ZEN, ZEC, and XLM] under federal securities laws.” The leaks don’t say what this memo says in detail.

Gabriel Shapiro, a crypto lawyer, was surprised that the SEC could see ZEC as security. He thought the agency’s apparent interpretation was worryingly broad.