Crypto VC funding increased by 15% in July, reflecting rising investor interest in blockchain infrastructure development.

In August, crypto venture capital (VC) funding experienced a notable resurgence, even as the broader crypto market dealt with summer liquidity challenges.

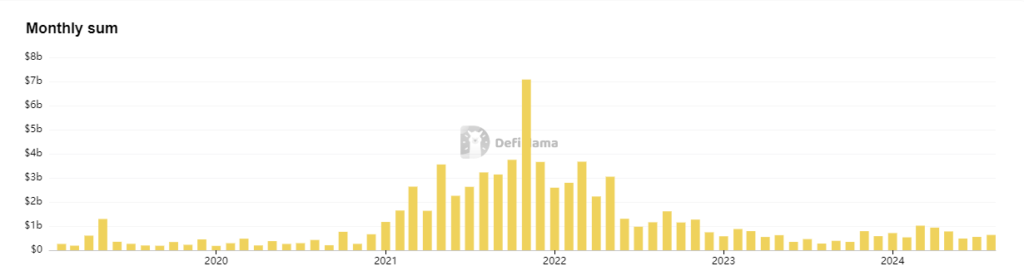

According to data from DefiLlama, crypto VC funding reached $633 million in August, a rise of over 15% from the $550 million recorded in July.

Luca Prosperi, CEO and co-founder of on-and-off-chain payments protocol M^0 Labs, noted that much of the VC interest has been focused on blockchain infrastructure development firms. He anticipates this trend will continue, explaining to Cointelegraph:

“Given the early stage of development, we anticipate continued investment at various levels: the infrastructure level, the middleware level (which connects the infrastructure seamlessly with the distributed application layer), and the application layer itself, where everything can be reimagined as it was during the late 1990s and early 2000s.”

VC capital plays a critical role in driving the progress of blockchain technology. The August increase in blockchain investments suggests a renewed focus on crypto, following a period when AI attracted much of the attention.

As an example of growing interest, on August 28, VC firm Lemniscap secured $70 million for a new fund aimed at early-stage Web3 startups.

Shifting Focus from AI to Crypto

During the summer, particularly in June, AI startups had captured the majority of VC attention. In one of the largest rounds in June, Sentient raised $85 million to develop an open-source AI platform, with backing from Founders Fund, Pantera Capital, and Framework Ventures.

However, according to Prosperi, some of these deep-tech investors are now shifting focus back to crypto. He explained:

“With the AI sector now reaching overcrowded peak levels, some of the same so-called deep-tech investors are turning their attention back to crypto, partly driven by a perception of a more favorable regulatory environment (a narrative that, in all fairness, does not seem to be firmly grounded in reality).”

Investors are also hoping that the upcoming US elections in November will provide more regulatory clarity for crypto, influencing global regulations for the next four years.

Real-World Use Cases Still Needed to Boost VC Investment in the Application Layer

Although infrastructure in blockchain is attracting considerable attention from investors, the space still lacks a major application use case that could drive mass adoption.

Ganesh Swami, CEO and co-founder of Covalent, highlighted this gap:

“VCs have not warmed up to the idea of investing in apps just yet and all of their interest is in infrastructure investments. For apps to succeed, you need a big user base and crypto hasn’t crossed the chasm yet. It’s early to invest in apps, though there are some promising signs.”

Swami also pointed to the approval of the first Bitcoin and Ether exchange-traded funds (ETFs) as a key factor in drawing VC attention back from the AI sector.