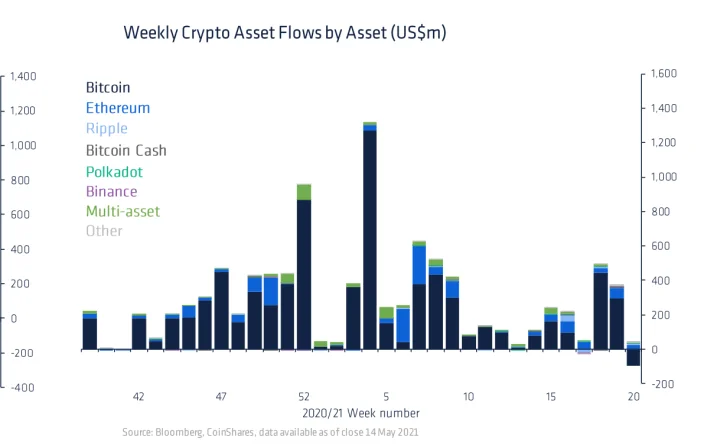

Investors pulled some $50 million from cryptocurrency funds a week ago, the main net recoveries of the year, as bitcoin‘s (BTC) cost tumbled.

As indicated by a report CoinShares, surges from bitcoin-centered assets added up to a record $98 million in the seven days through May 14, while speculation items zeroed in on other advanced resources kept on pulling in new cash.

The net sum actually represents a little part of the $5.6 billion put into cryptographic money finances this year, however, the surges show how rapidly a few financial backers were to withdraw as bitcoin started a value pullback that has now stretched out to as much as 35% from April’s record-breaking high.

“Investors have been diversifying out of bitcoin and into altcoin investment products,” according to CoinShares.

- Investor demand for investment products focused on ether (ETH) continued to rise, totaling $27 million last week.

- May marks the first month there has been more investment product trading volumes in ether relative to bitcoin.

- Digital asset investment products focused on ether traded a total of $4.1 billion for the week, versus bitcoin’s $3.1 billion.

- “We also saw inflows into other digital assets, the most popular being cardano (ADA) and polkadot (DOT), with inflows of $6 million and $3.3 million, respectively.”