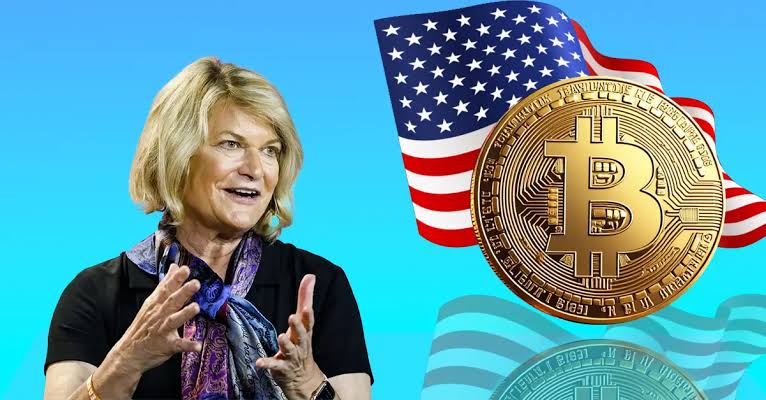

Senator Cynthia Lummis proposes selling U.S. gold reserves to buy 1M bitcoin for a national reserve without increasing debt.

Senator Cynthia Lummis, a Republican from Wyoming, has proposed a plan to sell a portion of the gold holdings owned by the Federal Reserve of the United States in order to raise money for the acquisition of one million bitcoins for a national strategic reserve.

Cynthia Lummis, a supporter of Donald Trump, who is going to become the next president, proposed this idea as a means of increasing the amount of Bitcoin held by the federal government without adding to the national debt.

Cynthia Lummis Proposes Fed Gold Sale To Buy 1M Bitcoin

Following Trump’s victory in the election, the price of Bitcoin has just surged to an all-time high of $93,500. This move coincides with the current rally. Bloomberg reports that Senator Lummis is planning to present legislation that would allow the Federal Reserve to sell a portion of its gold holdings and use the proceeds to purchase Bitcoin.

Her proposed legislation, known as the BITCOIN Act (Boosting Innovation, Technology, and Competitiveness via Optimized Investment Nationwide), would enable the Federal Reserve to acquire up to one million Bitcoins.

Taking into account the current market conditions, Cynthia Lummis thinks that this would cost approximately $90 billion; however, the total amount could increase if the market expects the intervention of the government.

Despite recent criticism from Bitcoin skeptic Peter Schiff, who argued that the reserve would be a poor idea for the United States, this action has nonetheless taken place. In spite of this, Lummis is of the opinion that the government might construct a Bitcoin stockpile by making use of the gold reserves that are already in existence without seeing an increase in the national deficit.

Due to the fact that the Federal Reserve’s gold assets are valued at a statutory price that is far lower than their market value, she pointed out that there is sufficient gold to support the purchase without putting the stability of the financial system in danger.

Despite the support of some MPs for cryptocurrency, Lummis’ plan is likely to encounter opposition. The measure currently has no co-sponsors, and Bitcoin’s volatility is a concern.

The head of the Center for Monetary and Financial Alternatives at the Cato Institute, Jennifer J. Schulp, made a statement on the hazards involved, adding that cryptocurrency market analysts and some members of Congress also question the practicality of retaining Bitcoin in a federal reserve over the long term.

“It’s still putting government money on the line, and Bitcoin has not shown itself to be a particularly stable asset.”

The head of Galaxy Digital, Michael Novogratz, who is worth a billion dollars, has expressed his uncertainty about the possibility of a national Bitcoin reserve. On the other hand, he suggested that if the United States decides to pursue such a scheme, it may result in competition on a global scale, with other countries possibly establishing their own reserves.

Rising Support Among Pro-Crypto Lawmakers in Congress

Lummis’ idea aligns with President-elect Trump’s recent endorsement of a federal Bitcoin reserve. The primary objective of Trump’s initial plan was to store Bitcoin assets that had been seized by law authorities, which amounted to approximately 200,000 tokens.

Lummis proposes that the bill would expand this by purchasing an additional one million tokens, which the government would retain for a minimum of twenty years. We anticipate the election of some pro-Bitcoin lawmakers during this period, potentially making the incoming Congress more receptive to cryptocurrency initiatives.

The cryptocurrency industry spent approximately $135 million to promote pro-crypto candidates during the 2024 election cycle. This resulted in what proponents of the cryptocurrency industry hope would be the most crypto-friendly Congress to date.

Lummis’ plan is not the sole initiative striving to establish a government-backed Bitcoin reserve. Representative Mike Cabell, a Republican from Pennsylvania, recently proposed a bill that would allow the state treasury to invest up to ten percent of its cash in Bitcoin.