Cyprus SEC has suspended the license application of FTX Europe until September 2024 following challenges in maintaining operations caused by the FTX crypto exchange collapse.

Until September 2024, the Cyprus Securities and Exchange Commission (SEC) has mandated that FTX Europe refrain from providing services under the suspension of its license.

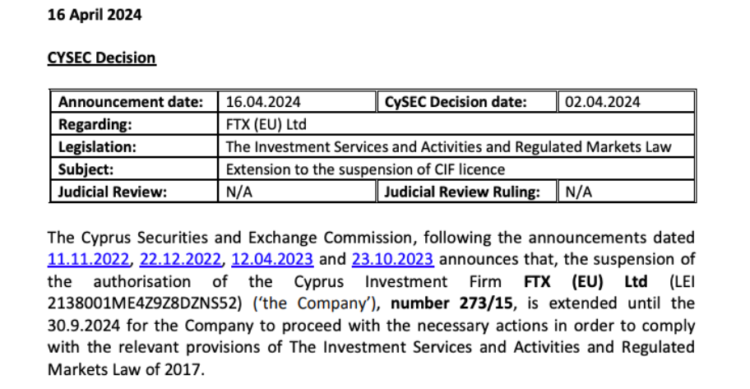

Officially announcing the news on April 16, the securities regulator of Cyprus ordered FTX Europe to take the required steps to comply with the applicable provisions of The Investment Services and Activities and Regulated Markets Law.

A regulatory decision prohibits FTX Europe from engaging in business transactions with any individual or accepting new clients, including providing investment services. According to the announcement, the firm has also been banned from advertising investment services.

The regulator, however, mandated that FTX Europe and its clients finalize all transactions at the request of said parties. Additionally, the Cyprus SEC mandated that the business return all client-attributable funds and financial instruments.

A few weeks before the discovery of the news, on March 28, a federal judge in the United States sentenced former FTX CEO Sam “SBF” Bankman-Fried to 25 years in prison on seven counts of fraud and conspiracy to launder money.

FTX Europe, an affiliated firm of FTX at its collapse in November 2022, was cited as one of the entities included in FTX’s Chapter 11 petition in the United States.

FTX Europe was formerly recognized as Digital Assets AG, a Swiss cryptocurrency firm established by Patrick Gruhn and Robin Matzke before its integration into the FTX empire. In 2021, Gruhn and Matzke executed a $323 million sale of the company to FTX, which subsequently adopted the name FTX Europe.

In February 2024, FTX divested its subsidiary FTX Europe back to its founders Gruhn and Matzke for $32.7 million after protracted bankruptcy disputes.

According to reports, Matzke stated that FTX’s European expansion was proceeding smoothly until its international failure in November 2022 and that the settlement was a positive development.

“We are pleased to facilitate prompt payments to European Union clients,” Matzke stated in February.