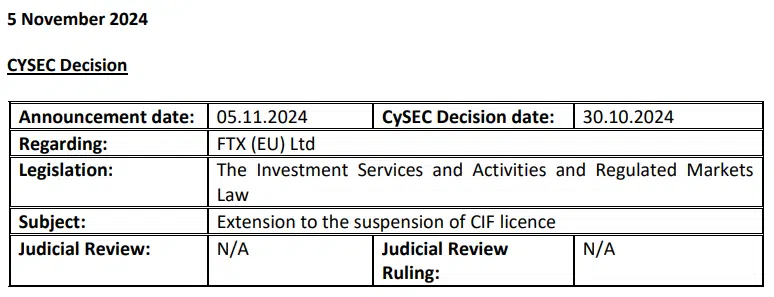

Cyprus’ securities regulator has extended the suspension of FTX’s European subsidiary by an additional six months.

On November 5, the Cyprus Securities and Exchange Commission (CySEC) issued a notice announcing that the suspension had been extended until May 30, 2025. This extension prohibits FTX EU from advertising, admitting new clients, or offering services.

The firm is still able to complete transactions and return funds to consumers.

It is the fourth extension of the moratorium since CySEC initially ordered the operations to cease on November 11, 2022, at approximately the same time FTX declared bankruptcy in the United States.

At the time, the company had only operated as a European Union-regulated investment firm for eight months, allowing for trading multi-asset derivatives.

CySEC suspended FTX Europe’s license in response to FTX’s declaration of Chapter 11 insolvency in Delaware, citing the “suitability of the members of the management body” and the necessity of protecting client assets.

Reports of a breach that had emptied as much as $600 million in crypto from FTX and FTX US-linked wallets were also circulating.

The original proprietors have since acquired FTX Europe.

In 2021, FTX acquired the Swiss startup Digital Assets AG, which was subsequently renamed FTX Europe, in a $323 million transaction.

FTX’s restructuring team endeavored to recoup the funds expended on the acquisition, contending that the acquisition price was a “massive overpayment.” However, this resulted in counter-litigation from the original proprietors.

Reuters reported in February that FTX had ultimately resolved the dispute regarding its European division by agreeing to sell FTX Europe back to its founders for $32.7 million.

The FTX Europe website no longer provides trading services; it merely provides a page for users to view their balance and request a withdrawal.

According to the Frequently Asked Questions section, clients who refrain from withdrawing their funds will maintain them in a “client-segregated account” for six years.