Changpeng Zhao calls crypto rules and governmental push for cryptocurrencies a “very positive direction” for the industry.

Changpeng “CZ” Zhao, co-founder and former CEO of Binance, expressed optimism about the future of cryptocurrency regulation globally, particularly in light of the upcoming U.S. presidential election.

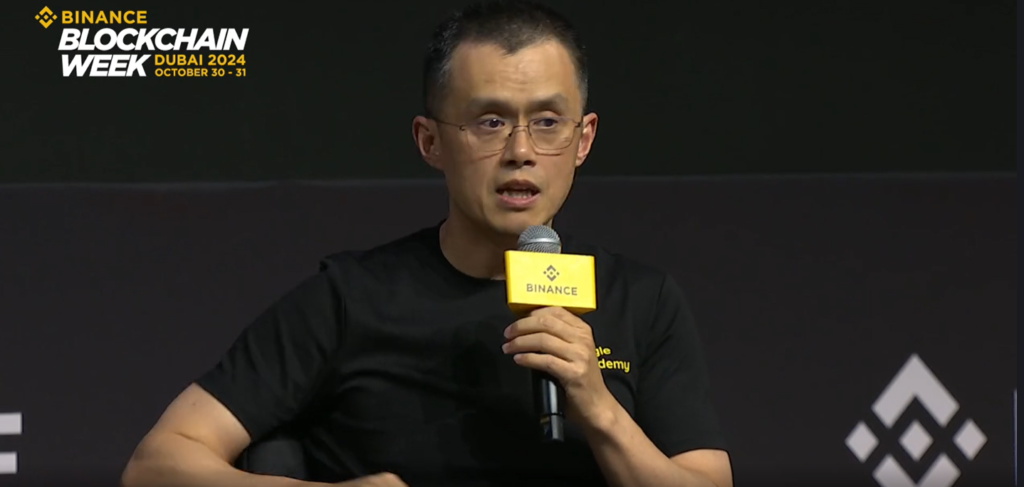

In his first public address since his release from prison, Zhao shared his views during an Oct. 31 fireside chat at Binance Blockchain Week, saying:

“Overall [cryptocurrency regulation] is actually moving in a very positive direction… By June, Donald Trump is pro-crypto. By the end of June, both parties are pro-crypto. I’m still sitting in prison, like what the hell happened?”

Zhao suggested that the evolving perspectives on crypto signal growing public interest in digital assets, though he refrained from speculating on the election’s outcome.

Released on Sept. 27 after serving four months in a U.S. federal prison for Anti-Money Laundering (AML) violations, Zhao’s comments come just ahead of the Nov. 5 U.S. presidential election, marking the first time crypto has become a central issue in the campaign.

US Political Push for Pro-Crypto Regulation

While Zhao is optimistic, others in the crypto space have raised concerns. Paxos CEO Charles Cascarilla, in an open letter to Donald Trump and Kamala Harris, encouraged the next U.S. president to support stablecoin regulation to bolster the dollar’s global status and address inefficiencies in the current banking system.

In his Oct. 29 open letter, Cascarilla argued that blockchain and stablecoins are “replatforming the financial system” to align with the digital age:

“Stablecoins or digital dollars—U.S. dollars digitized via blockchain technology—are the crucial upgrade for the payment system that will revolutionize money movement, allow greater participation in the global economy and ensure the supremacy of the U.S. dollar for years to come.”

He emphasized that stablecoins are necessary for modernizing the financial system, which he described as “closed, outdated and inefficient,” calling for innovation-friendly crypto policies.

Former President Donald Trump is perceived as more supportive of crypto and innovation, potentially favoring a less restrictive regulatory stance compared to his opponent, Vice President Kamala Harris.

Is the US Lagging Behind in Crypto Regulation?

During the fireside chat, Zhao acknowledged that developing regulatory frameworks in large economies like the U.S. can be a slower process.

Some investors, however, worry that the U.S. might be falling behind on crypto regulation, particularly with the European Union’s Markets in Crypto-Assets Regulation (MiCA) set to take effect by the end of 2024, establishing the world’s first comprehensive crypto framework.

On a positive note, MiCA could encourage the creation of a global stablecoin regulatory framework, according to a Binance spokesperson:

“By setting clear rules on issuance, reserve management, and redemption, MiCA enhances market stability and consumer protection, while also fostering innovation through legal certainty.”

In preparation for Europe’s regulatory shift, financial institutions like Societe Generale, the world’s 19th largest bank, have teamed up with Bitpanda to launch a MiCA-compliant stablecoin, the euro-backed EUR CoinVertible (EURCV).