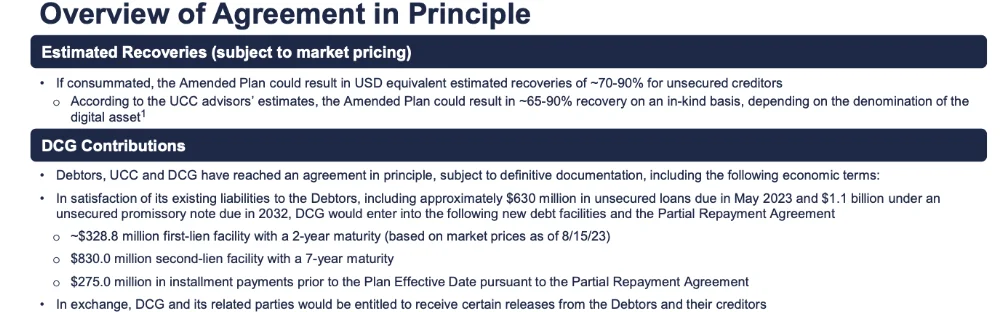

Digital Currency Group (DCG), a leading cryptocurrency venture capital firm, has agreed in principle with creditors of its crypto lending subsidiary, Genesis, once carried out the plan recoveries could amount to 70%–90% for Genesis creditors

According to a court filing published on August 29, the estimated dollar equivalent recoveries for unsecured creditors could range from 70% to 90% if the amended plan is approved.

The filing indicates that the amended plan could result in a 65–90% in-kind recovery, depending on the digital asset’s value.

DCG would also enter into the new debt facilities and the partial repayment agreement to satisfy its obligations to creditors, including $630 million in unsecured loans due in May 2023 and $1.1 billion under an unsecured promissory note due in 2032. The debts consist of a $328.8 million, two-year first-lien facility and a $830 million, seven-year second-lien facility.

Following the partial repayment agreement, DCG would also pay $275 million in installments before the plan’s implementation date, according to the filing.

Genesis is one of many cryptocurrency lending companies impacted by 2022’s enormous bear market, declaring bankruptcy in January 2023. The business owed over $3.5 billion to its top 50 creditors, which included Gemini and VanEck’s New Finance Income Fund.

As previously reported, Genesis halted withdrawals in the middle of November 2022, citing unprecedented market volatility caused by the bankruptcy of the FTX cryptocurrency exchange. The company asserted that the event led to an “abnormal” number of withdrawals that exceeded its liquidity.