A DAO lacks centralized leadership. Bottom-up decisions are made by a community regulated by blockchain-enforced norms. This article discusses creating DAOs

Decentralized Autonomous Organizations: What are they?

Decentralized Autonomous Organizations lay down the rules of the road for all corporations. Private agreements, such as shareholder contracts, between firm owners could constitute such governance standards. Since corporations traditionally have only acted via persons or other corporations, the law can also require the enforcement of such agreements.

There are two major problems with enforcing rules, though: first, parties don’t always abide by the rules, and second, parties don’t always agree to the rules before they’re put into effect. Who, then, suffers the most consequences?

Mismanagement of funds and losses are more likely to occur when stakeholders have little to no say in governance choices or are unable to take action when they see issues. Is there anything that can be done to fix this issue?

The aforementioned problems can be addressed with a solution known as decentralized autonomous organizations (DAOs). If there is no central authority, then what is the point of a decentralized autonomous group?

Because of their openness, DAOs can solve the Principal-Agent dilemma (more on this later). A DAO, though, what is that?

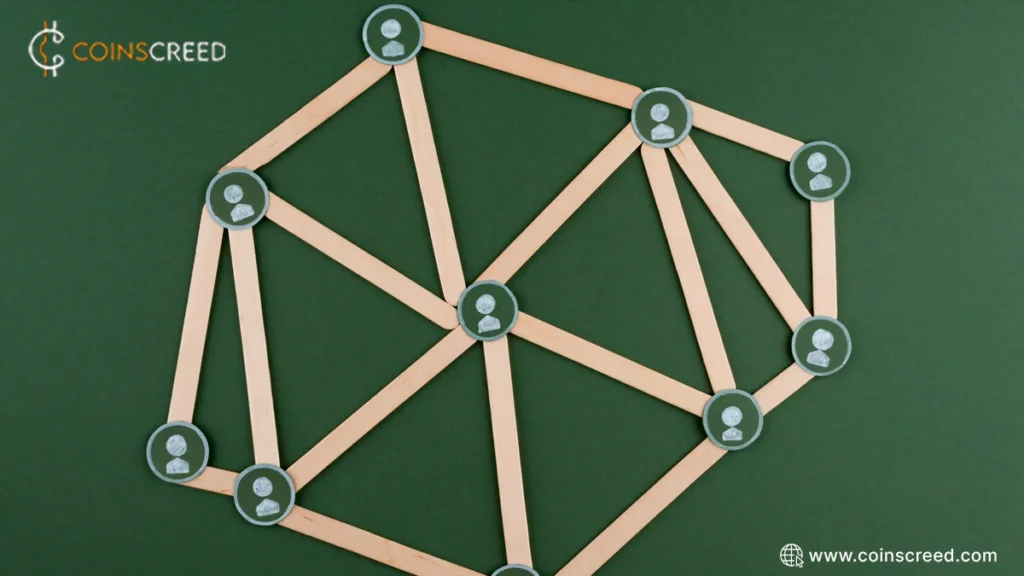

DAOs are decentralized autonomous organizations (DAOs) in which participants manage donated funds without the need for a third party through the use of smart contracts and the underlying distributed ledger technology known as the blockchain.

To participate in a DAO, users must first acquire the network’s native coin. Virtual worlds like Decentraland and DASH are just a few instances of decentralized autonomous organizations. But the first truly successful DAO was BitShares, the decentralized cryptocurrency, and online marketplace. Founder Dan Larimer coined the term “decentralized autonomous company” to describe Bitshares.

To add, in 2016, Slock. created the first decentralized autonomous organization (DAO; investor-operated VC firm) on the Ethereum blockchain. However, a software fault was discovered, which allowed an attacker to steal $70 million in Ethereum from the DAO (ETH).

What is a DAO on the blockchain? How do they function? What are the different kinds of DAOs? Why are they useful? And how can you make one? All of these questions and more will be answered in this comprehensive guide.

How do DAOs work?

The DAO’s rules are established by a small group of volunteers and written into smart contracts. These smart contracts provide the foundation for the DAO’s activities and are transparent, verifiable, and publicly auditable. Any prospective participant can learn the complete protocol’s workings with their help.

After these regulations have been codified on the blockchain, the DAO can move on to figuring out how to acquire funding and how exercise governance.

This is often done through the sale of tokens issued by the protocol to replenish the DAO’s treasury. In exchange for their token investment, token holders are granted voting rights that are typically proportional to the size of their token holdings. Once funding is finalized, the DAO can be launched.

Developing DAO code is accomplished through the “Solidity” programming language. If a DAO is deployed on the Ethereum blockchain, it will begin operating. Once a DAO’s code is live on the Ethereum blockchain, it needs Ether (ETH) to conduct transactions on the Ethereum network. Since a DAO’s first order of business is to acquire ETH, that currency is essential to its operation. The initial creation phase of a DAO is when ETH is sent to the DAO’s smart contract address, which occurs after the deployment of the DAO’s code.

No single entity has the authority to alter the DAO’s rules once the code has entered production. Rather, any changes must be approved by a majority of the membership. The decision rests solely on the DAO’s token holders.

DAO types

Here are some types of Decentralized Autonomous Organizations;

- Collector DAOs

- Protocol DAOs

- Service DAOs

- Grant DAOs

- Social DAOs

- Media DAOs

- Entertainment DAOs

- Investment DAOs

How to create a DAO

- Establish a solid foundation

- Find out who owns what

- Organize governance

- Incentivize and reward

Establish a solid foundation

The first thing to do is discuss with other people in your field to figure out why DAO is necessary, what function it will provide, and how it will operate. Human decision-making is required for the development of a DAO to see the opportunity, maybe recruit co-collaborators, validate the need, and sketch the processes that can be mechanized and put into smart contracts.

To eliminate the possibility of disagreement on the DAO’s governance structure, it is crucial to clarify the purpose with other DAO enthusiasts. You’ll also need some sort of encrypted wallet that may be used for making purchases and storing funds.

Investors and potential funders will first want to know where the company will be making money before deciding whether or not to put money into it. What business model does a DAO employ to generate revenue?

For DAOs, dividends are the main way to bring in money. Dividends are a form of income that DAOs might receive from the investments they make. The people who create DAOs can potentially profit by convincing their peers to put money into it.

Find out who owns what

When all parties involved in a DAO agree on its purpose, the next step in the process is to create a system of shared ownership that will foster the group’s continued growth and development. Since ownership in a DAO is typically tokenized, it can be transferred to members in many different ways. Airdrops and incentives are the two most common ways that DAOs distribute funds.

Tokens are airdropped to users whose participation and actions are deemed valuable to the community as a whole. Members who go above and above the call of duty are rewarded with bonuses. Members can participate in the community by receiving benefits in the form of native tokens. Decentralized exchanges, like Uniswap, also facilitate the acquisition of tokens.

Organize governance

The process by which choices will be made after a DAO is established is decided upon at this level. The rules for making decisions are most often established through a process known as “token weighted voting.” Token holders participate in the voting process, with each token equaling one vote. Ideas are submitted by users using a Snapshot-like tool, voted on depending on the preferences of other members, and then implemented automatically using smart contracts.

Incentives and rewards

Trust can be cultivated among DAO members and contributors by providing them with incentives in the form of rewards. Members and collaborators who have ever utilized the considered DeFi protocol receive native governance tokens. These tokens are used to symbolize ownership in a company, but they are worthless on the open market.

Contributions to a DAO may be rewarded in a variety of ways, including monetary cryptocurrencies such as Ether (ETH), Tether (USDT), USD Coin (USDC), or even titles and grades. When the DAO design phase is complete, the incentive framework can be modified.

Conclusion

Future corporate employment is improbable for the average person. People will make money through learning new skills, making art, playing video games, and curating knowledge.