The funds will be used to expand Glow’s solar grid in India, which is projected to replace the energy consumption of 34,000 households.

Ethereum-based platform Glow has secured $30 million from venture capitalists to expand its decentralized solar farm initiatives.

Framework Ventures and Union Square Ventures led the funding round, with participation from Lattice Ventures, Protocol Labs, Hack VC, HF0, and Alliance DAO, according to an Oct. 31 announcement.

The new funds will go toward scaling a solar grid expected to provide energy for 34,000 homes in India.

David Vorick, founder and CEO of Glow Labs, shared that “In less than a year, Glow has grown from a rooftop solar project in the US to a network with several multimillion-dollar solar farms in India.

The solar farms that have already been built are projected to eliminate more than 85,000 tons of CO2 emissions over their lifetime.”

DePIN protocols, or decentralized physical infrastructure networks, use blockchain to let individuals jointly own, manage, and earn from infrastructure like solar grids, wireless networks, and data storage.

Contributors of physical assets, such as energy nodes, are rewarded with digital tokens, making these projects both economically viable and scalable.

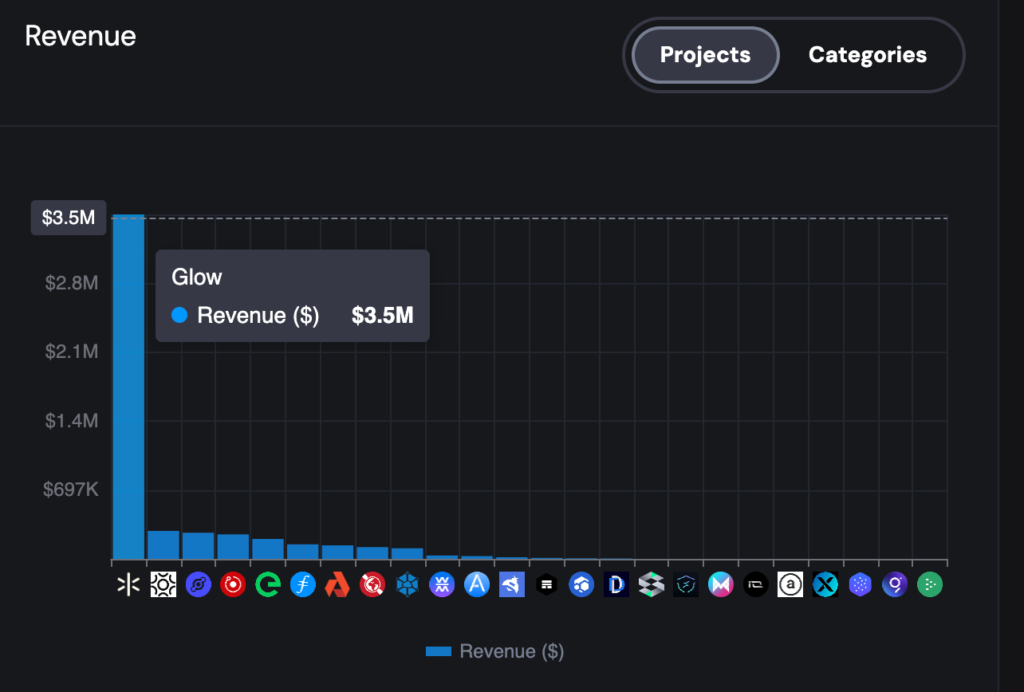

According to data from DePIN.Ninja, Glow leads the DePIN sector in profitability, having earned over $3.5 million in revenue since its 2023 beta launch—surpassing other networks, including Helium.

Glow reports slightly higher earnings of $5 million, attributing the recent gains to expansion in Rajasthan, India, over the past 40 days.

Glow rewards solar farms in its network with GLW tokens for energy production and stablecoin rewards for carbon credits.

This incentive structure focuses on rewarding farms that deliver high environmental impact, especially in areas where clean energy can significantly reduce carbon emissions.

Power Ledger, another DePIN protocol, supports decentralized energy through peer-to-peer trading, allowing consumers to sell excess energy directly to neighbors.

“We think DePIN can be a powerful tool for rolling out physical infrastructure across the world,” stated Framework Ventures co-founder Michael Anderson.