Deutsche Bank partners with Singapore’s central bank for asset tokenization under MAS Project Guardian, focusing on wholesale funding markets and DeFi.

The Central Bank of Singapore is working with Deutsche Bank, a multinational investment bank based in Germany, on asset tokenization.

The Monetary Authority of Singapore (MAS) has enlisted Deutsche Bank in Project Guardian. This initiative aims to tokenize assets in wholesale funding markets and decentralized finance (DeFi) applications.

Deutsche Bank will test an open architecture and interoperable blockchain technology to support tokenized and digital funds as part of the partnership. Additionally, the bank will suggest protocol guidelines and determine the most effective strategy to advance the industry.

Boon-Hiong Chan, head of securities and technology for Deutsche Bank’s Asia Pacific region, will represent the bank’s Project Guardian. The software-based platform Memento Blockchain, which focuses on DeFi and digital asset management, is anticipated to collaborate closely with the bank.

In 2022 and 2023, Deutsche and Memento Blockchain collaborated to successfully execute a proof-of-concept known as Project DAMA, or Digital Assets Management Access.

This program will make a more effective, safe, and adaptable digital fund management and investment servicing system possible.

The new Deutsche Bank is working toward implementing DAMA 2. Interop Labs, the original creator of the Axelar network, a significant interoperable blockchain, will be involved in the development.

The Axelar Foundation has collaborated with a few significant cryptocurrency companies, such as Ripple, to enable interoperability on their blockchain networks.

In February 2024, Ripple and Axelar announced their partnership, with the ultimate goal of tokenizing the XRP Ledger’s real-world assets (RWA) and making them interoperable via Axelar.

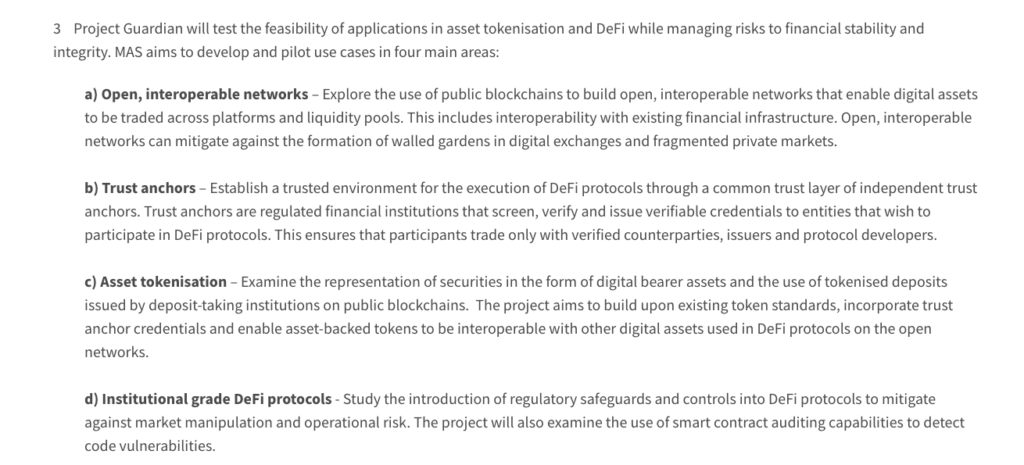

Project Guardian is a cooperative effort between the Financial Conduct Authority of the United Kingdom, the Financial Market Supervisory Authority of Switzerland, and the Financial Services Agency of Japan. It was started by Singapore’s MAS and launched in 2022.

Deutsche Bank joined Singapore’s tokenization project a few days after releasing a report on stablecoins that raised concerns about the transparency of significant issuers. Tether has since criticized Deutsche Bank for the report’s assertions, highlighting the lack of substantial evidence or hard data to back up the claims.

With the most significant percentage of trades in the cryptocurrency market, Tether’s USDT stablecoin has grown to be a significant player. With a total market value of around $111 billion, it is also the biggest stablecoin in the world.