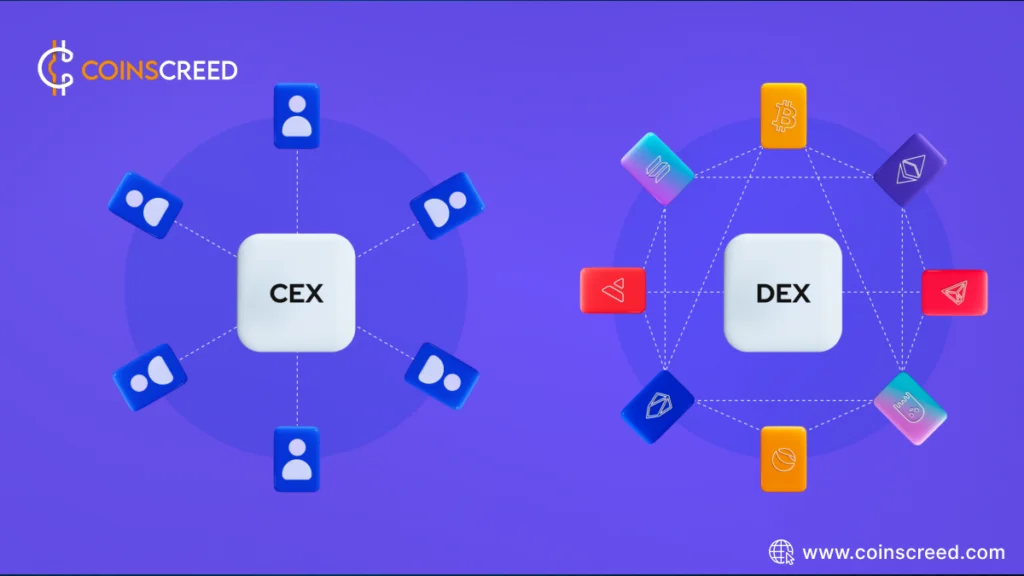

The debate between Decentralized Exchanges (DEXs) and Centralized Exchanges is ongoing. In this article, we will explore the advantages and drawbacks between DEXs vs. centralized exchanges.

Understanding Decentralized Exchanges (DEXs)

What is a Decentralized Exchange?

A decentralized exchange is a peer-to-peer marketplace where users can trade cryptocurrencies without needing an intermediary to facilitate the transfer and custody of funds.

Decentralized exchanges operate on the principles of blockchain technology, offering users increased security, privacy, and control over their funds.

Advantages of Decentralized Exchanges

There are numerous advantages of decentralized exchanges. They include:

- Token availability

- Anonymity

- Reduced security risks

- Reduced counterparty risk

Token availability

Before listing tokens, centralized exchanges must check each individually to ensure it follows local rules.

However, decentralized exchanges can include any token created on the blockchain for which the DEX was made.

You can expect new projects to debut on these exchanges before they hit the centralized ones.

Anonymity

On DEXs, users can anonymously trade cryptocurrencies. In contrast to centralized exchanges, users do not need to do Know Your Customer (KYC) verification.

As part of the KYC process, traders’ personal information, such as their full legal name and a photocopy of a government-issued ID, is gathered. As a result, DEXs attract a large number of people who wish to be anonymous.

Reduced security risks

Experienced cryptocurrency users who custody their funds are at a reduced risk of being hacked using DEXs, as these exchanges do not control their funds.

Instead, traders guard their funds and only interact with the exchange when they wish to do so. If the platform gets hacked, only liquidity providers may be at risk.

Reduced counterparty risk

Counterparty risk happens when the other party involved in a transaction does not fulfill its part of the deal and defaults on its contractual obligations.

Smart contracts and decentralized exchanges eliminate the need for intermediaries, thereby eliminating this risk.

Drawbacks of Decentralized Exchanges

Despite their numerous benefits, DEXs are not without their risks. They include:

- Smart Contract Risk

- Liquidity Risk

- Centralization

- Network risk

- Token Risk

Smart Contract Risk

Blockchains are considered highly secure for executing financial transactions. Smart contracts, on the other hand, have a code that depends on how skilled and experienced the team that made them is.

Decentralized exchange (DEX) users can lose money when smart contracts have bugs, hacks, vulnerabilities, or exploitations.

Peer-reviewed code, security audits, and sound testing practices can help developers lower this risk, but they should always be careful.

Liquidity Risk

DEXs are becoming increasingly popular, but some need better liquidity conditions because they have a lot of slippage and do not give users the best experience.

As a result of the way network effects of liquidity work (high liquidity attracts more liquidity, low liquidity attracts less liquidity), a lot of trading still happens on centralized exchanges. This means that DEX trading pairs often need more liquidity.

Centralization

While many DEXs aim to maximize their decentralization and censorship resistance, points of centralization can still be present.

There are some issues with the DEX that need fixing. For example, by hosting the matching engine on centralized servers, the development team has administrative access to the smart contracts, and the infrastructure for bridging tokens could be better.

Network risk

Since a blockchain facilitates the exchange of assets, using a DEX may be prohibitively expensive or impossible if the network experiences congestion or downtime, making DEX users susceptible to market fluctuations.

Token risk

As many DEXs feature permissionless market creation—the ability for anyone to create a market for any token—the risks of buying low-quality or malicious tokens can be higher than in centralized exchanges.

DEX users need to consider the risks associated with participating in early-stage projects.

Understanding Centralized Exchanges

What is a Centralized Exchange?

A centralized cryptocurrency exchange is a platform for trading digital currencies under the control of one central organization that serves as a middleman between cryptocurrency buyers and sellers.

How does a Centralized Crypto Exchange Work?

A centralized exchange (CEX) stores digital assets on behalf of clients and facilitates crypto trading mechanics while determining the trading terms and conditions.

Advantages of Centralized Exchanges

There are numerous benefits of decentralized exchanges. They include:

- User-Friendly Interface

- Extensive Cryptocurrency Support

- Higher liquidity

- Access to Regulated Entities

User-Friendly Interface

Centralized exchanges prioritize a user-friendly design, making it easy for both beginners and experienced users to navigate, deposit, and withdraw funds seamlessly.

Extensive Cryptocurrency Support

Established centralized exchanges typically offer a broader range of cryptocurrencies for trading than decentralized exchanges. This diversity benefits users looking to diversify their investment portfolios.

Higher Liquidity

Centralized exchanges boast higher liquidity than their decentralized counterparts. This liquidity facilitates swift transactions at lower volatility, which is crucial for traders. The increased liquidity is attributed to a larger pool of buyers and sellers and support from regulated market makers.

Access to Regulated Entities

Numerous regulated entities own centralized crypto exchanges, subjecting them to strict regulatory oversight. This regulatory conformity appeals to institutional investors and professional traders seeking a secure environment for cryptocurrency dealing.

Drawbacks of Centralized Exchanges

Despite their numerous benefits, centralized exchanges are not without their risks. They include:

- Lack of Control

- Security Vulnerabilities

- Susceptibility to Rug Pulls

- Regulatory Oversight and Restriction

- Conflicts of Interest and Unethical Practices

Lack of Control

Users on centralized exchanges have no direct control over their crypto wallet keys, leaving them vulnerable to potential losses, especially if the exchange unexpectedly shuts down.

Security Vulnerabilities

Centralized exchanges are prone to high-profile hacks, resulting in substantial losses of cryptocurrencies. The centralized nature of these platforms makes them attractive targets for cyber attacks.

Susceptibility to Rug Pulls

The central authority controlling many exchanges makes them susceptible to rug pulls, leading to investors losing money. This vulnerability arises due to the concentrated control and potential points of failure within a centralized structure.

Regulatory Oversight and Restriction

Centralized exchanges controlled by regulated entities are subject to regulatory authorities’ oversight, leading to potential restrictions and compliance requirements. This regulatory control can limit the exchange’s ability to support certain tokens or serve users in specific jurisdictions.

Conflicts of Interest and Unethical Practices

Centralized exchanges, driven by profit motives, may experience conflicts of interest between owners and users. This can result in unethical practices such as market data manipulation, negatively impacting the user experience and eroding trust in the exchange.

DEXs vs. Centralized Exchanges: What are the Differences?

Centralized exchanges have been more popular and have been around for longer than decentralized ones. However, decentralized exchanges have gained popularity in recent years due to their advantages in terms of privacy, security, and control over funds.

Here are some general differences between the two types of crypto exchanges: However, this might not be necessarily true for all centralized and decentralized exchanges.

Conclusion

In conclusion, the choice between DEXs and centralized exchanges depends on individual priorities.

While DEXs offer enhanced security and privacy, centralized exchanges provide higher liquidity and user-friendly interfaces.

As the crypto space evolves, staying informed about the advantages and drawbacks of each is essential for making sound investment and trading decisions.