Dogecoin price has recovered from a previous dip on June 21. DOGE has had its own good and bad days since the beginning of the year.

On June 21, the price of Dogecoin plummeted, leaving a giant red candle in its wake, erasing any prospect of reversing a period of underperformance.

DOGE, on the other hand, has now rebounded from its steep drop, indicating that the bulls’ interest is growing.

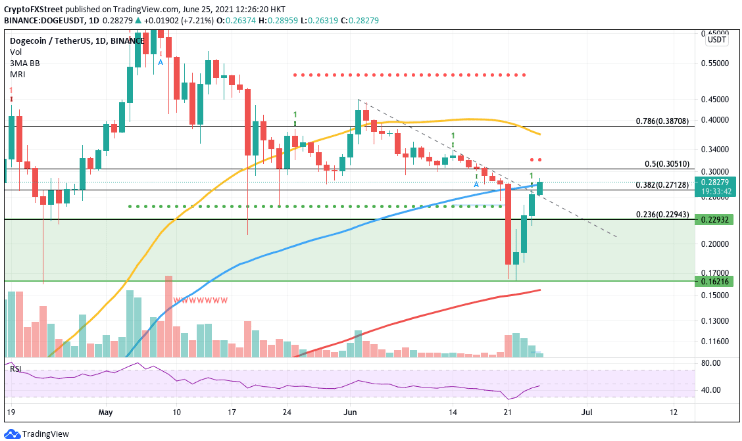

Since June 2, the price of Dogecoin has been trading within a topside descending trend line.

DOGE’s negative outlook has been trapped by this resistance trend line, as the meme-based coin has continued to record lower highs and lower lows on the daily chart.

While the price of Dogecoin has been under constant selling pressure since early June, the precipitous drop was sparked when DOGE failed to maintain trading above the 100-day Simple Moving Average (SMA), which has served as support since November.

On June 21, a break below this critical line of defense resulted in a 42 percent drop, marking the lower barrier of the demand zone at $0.162.

Dogecoin’s price appears to be on the rise, printing its fourth consecutive green candle on the daily chart, spurred by optimistic mood as DOGE engineers roll out a major network upgrade.

DOGE has broken through the declining resistance trend line that has held the meme coin hostage for nearly a month, as well as the 38.2% Fibonacci extension level of $0.271.

Investors should also take note that the price of Dogecoin has risen over the 100-day SMA; nevertheless, only a daily closure above this level would indicate continued bullish momentum.

On the June 24 candle, the Momentum Reversal Indicator (MRI) also displayed a buy signal, supporting the bullish thesis.

To increase the chances of DOGE achieving the 50% Fibonacci extension milestone at $0.305, the price must remain above the 100-day SMA and the diagonal trend line.

If this next goal is met and held as support, the canine-themed coin’s larger aspirations for the 50-day SMA should not be ruled out.

DOGE is anticipated to retest the 38.2 per cent Fibonacci retracement level before falling toward the start of the demand barrier at $0.229, which coincides with the 23.6 per cent Fibonacci retracement level if it fails to close above the 100-day SMA and retreats from the current uptrend.

If Dogecoin fails to hold the aforementioned important support levels, the price will be locked below the descending resistance level, consolidating until a strong upside release develops.