The multi-chain network Polkadot is showing bullish signs as its native token DOT surges above $5.5. The Web3 Foundation, associated with Polkadot, has also announced a pilot investment of $1 million in tokenized U.S. treasury bills.

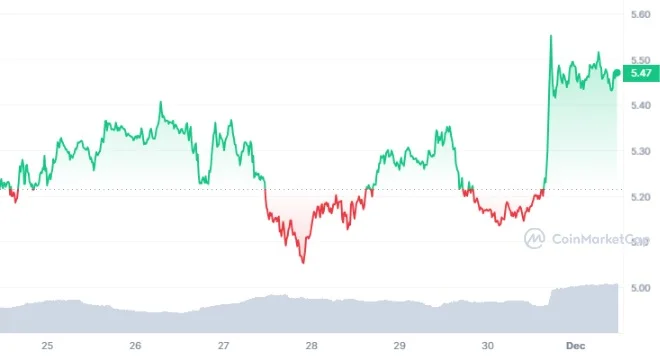

The DOT price has gained more than 6.25% in the last 24 hours and is trading at a $5.50 level at the time of writing. DOT is undergoing a trend reversal from its lows of $3.50, experiencing a notable surge of over 55%.

Technical indicators suggest that the DOT price has maintained its gains in neutral territory, with expectations of reaching the swing high point of $7.00 in the upcoming sessions.

DOT price breaks out of consolidation and targets $7.0

The DOT price has been consolidating in a narrow range between $4.0 and $5.0 for the past few weeks, forming a symmetrical triangle pattern on the daily chart.

However, on November 28, the DOT price broke out of the triangle and closed above the resistance level of $5.0, signaling a bullish continuation.

The breakout was accompanied by a significant increase in volume and momentum, indicating strong buying pressure. The DOT price also managed to trade above the crucial moving averages of 50-day, 100-day, and 200-day, demonstrating strength.

Furthermore, the current price action favors the bulls, indicating that DOT can enter the blue sky zone above $7.0 and experience a significant surge in the next few sessions.

At the time of writing, DOT is trading at $5.5, with its 24-hour trading volumes jumping by 51% to $288 million. The observed price action also reflects investors’ interest and commitment to maintaining a bullish sentiment.

Currently, DOT is trading very close to its previous rejection levels of $5.73, which could act as a minor resistance. If the DOT price can overcome this hurdle, it could target the next resistance level of $6.0, followed by the psychological level of $7.0.

The RSI curve remained in the overbought zone, forming a positive divergence that hints at the potential to reach the blue sky zone around $7.0 in the near future.

Conversely, the MACD indicator also indicated a bearish crossover along with red bars on the histogram, pointing to a potentially volatile outlook in the upcoming sessions. Therefore, traders should exercise caution and use proper risk management techniques while trading DOT.

Web3 Foundation invests in tokenized U.S. treasury bills

In addition to the positive price action, Polkadot received a boost from the Web3 Foundation, the non-profit organization that supports the development of the Polkadot ecosystem.

In a recent announcement, the Web3 Foundation revealed plans for a pilot investment of $1 million in U.S. treasury bills, tokenized on-chain through Anemoy.

Anemoy operates on Centrifuge Chain, a Polkadot parachain focusing on real-world assets (RWA). The investment is directed towards Anemoy’s upcoming Liquid Short Treasury Fund, aiming to expose DAOs and other investors to short-term U.S. treasury bill yields.

This move underscores the Web3 Foundation’s dedication to supporting the growth of real-world assets on Polkadot’s infrastructure.

“This partnership demonstrates Web3 Foundation’s commitment to supporting the growth and innovation of real-world assets on Polkadot’s infrastructure”

The Web3 Foundation

The announcement also stated that the investment will be made using the Web3 Foundation’s treasury funds, held in DOT tokens. The investment will be executed using Anemoy’s decentralized exchange, which allows for the conversion of DOT to U.S. dollars and vice versa.

The Web3 Foundation’s investment in tokenized U.S. treasury bills is a significant milestone for the Polkadot ecosystem, as it showcases the potential of bridging the gap between traditional and crypto finance.

It also reflects the growing trend of crypto development teams allocating treasury assets to real-world assets, such as U.S. treasuries, stocks, and real estate. This trend aims to diversify the risk profile and generate stable returns for the crypto projects.

Polkadot works on a system to replace the parachain auctions

In addition to the Web3 Foundation’s investment, Polkadot is also working on a system to replace the parachain auctions, which are the mechanism for allocating slots on the Polkadot network to different projects.

The parachain auctions have been criticized for being inefficient, expensive, and unfair, as they favor projects with large amounts of capital and hype.

According to Gavin Wood, the co-founder of Polkadot and the Web3 Foundation, the new system will be based on a concept called “parathreads,” which are similar to parachains but with lower costs and more flexibility.

Parathreads will allow projects to pay for the network resources they use, rather than bidding for a fixed slot. Parathreads will also enable projects to switch between being a parachain and a parathread, depending on their needs and preferences.

Wood added that the parathread system would be more efficient, fair, and scalable than the parachain auction system since it would allow additional projects to join Polkadot and benefit from its security and interoperability. He added that the parathread system will be introduced “in a few months” after the current parachain auctions.