Bybit, the world’s second-largest crypto exchange by derivatives volume, has obtained a two-year provisional license in Dubai after establishing its headquarters in the city.

An announcement shared with Cointelegraph indicates that the Virtual Asset Regulatory Authority (VARA) has granted a non-operational license to the centralized crypto exchange (CEX).

According to Helen Liu, the chief operating officer, the new license is a significant milestone in Bybit’s global expansion strategy. This milestone is being propelled by Dubai’s aspiration to become a leading blockchain hub.

She disclosed to Cointelegraph:

“Dubai’s strategic location, progressive policies, and innovation-driven environment offer unparalleled opportunities for businesses and investors in the cryptocurrency sector.”

As many crypto companies relocate there, Dubai rapidly becomes a global hub with crypto-friendly regulations.

The Securities and Commodities Authority (SCA) and VARA announced on Sept. 9 that UAE regulators will permit Dubai-licensed virtual asset service providers (VASPs) to provide nationwide services. This development is a significant regulatory advancement.

Bybit competes for operational crypto authorization in Dubai

The provisional license allows Bybit to serve retail and institutional investors in Dubai; however, the exchange is still in the process of obtaining a full operational license in the region.

In 2022, the exchange relocated its headquarters to Dubai. It recently renewed its partnership with the Dubai Multi Commodities Crypto Centre (DMCC), transitioning from an ecosystem partner to a critical advisory role.

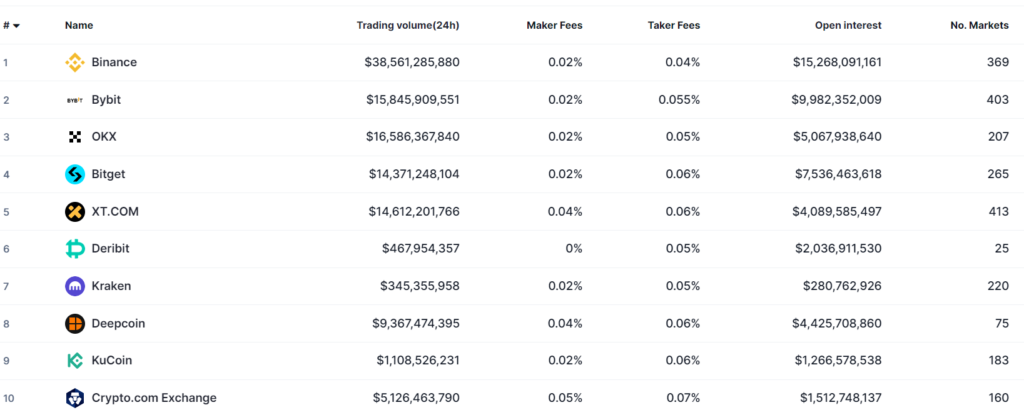

According to CoinMarketCap data, Bybit is the second-largest crypto exchange in the world by 24-hour derivatives volume, with a volume of over $15.8 billion on Sept. 16. This volume is second only to Binance’s $38.5 billion.

Dubai: The Next Global Crypto Hub?

Dubai has been making substantial regulatory progress to attract more Web3 and crypto firms seeking more crypto-friendly regimes.

Cointelegraph reported on Aug. 16 that the Dubai Court of First Instance has recognized salary payments in crypto as valid under employment contracts, a significant enhancement to the country’s regulation.

On June 5, two months prior, the Central Bank of the UAE authorized the implementation of a new stablecoin licensing and monitoring system.

After co-founder Changpeng Zhao relinquished his voting rights in the exchange’s local entity, Binance, the world’s largest crypto exchange by volume, achieved a long-awaited virtual asset service provider license in Dubai in April.

On May 8, Chainalysis, a prominent onchain security firm, established regional headquarters in Dubai. The firm has been “actively engaging” with local government stakeholders to provide advice on best practices for regulatory development in the crypto industry, which fuels innovation.