Uncertain regulatory conditions continue to hinder the DAO ecosystem’s sustainable development, according to a new ECB occasional paper.

The occasional paper (OP) of the European Central Bank (ECB) suggests that decentralized autonomous organizations (DAOs) require a comprehensive regulatory framework if they are to have a future in the financial sector.

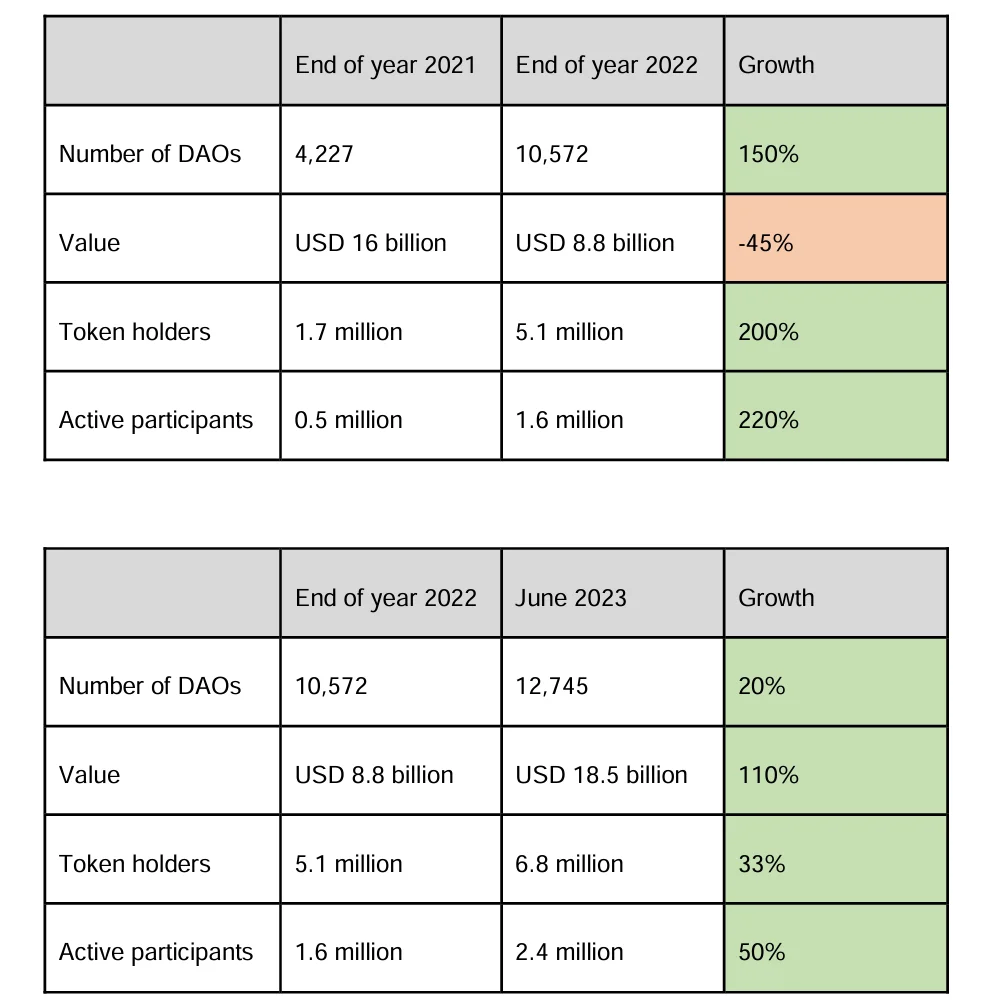

The OP “The future of DAOs in finance – in need of legal status,” written by Ellen Naudts, Market Infrastructure Expert Payments at ECB, highlighted how technology outpaced regulation concerning DAOs, negatively impacting ecosystem safety and development.

As DAOs flood the market with unique offerings, enforcing a “registration framework built for a pen-and-paper era” fails to address the numerous risks they pose to investors. The paper concluded:

“Until DAOs are adequately regulated globally, in the sense that the abovementioned challenges have been solved so that they do not and will not in future pose a serious threat to financial stability, payments and securities systems operate smoothly and consumers are properly protected, the place for DAOs in the financial sector of the future will necessarily remain limited,”

Alongside proposals for establishing a regulatory framework, ECB executive board member Fabio Panetta recently stated that the digital euro could “put Europe at the forefront of advanced economies.”

🧵 A digital euro would be a new form of central bank money, says Executive Board member Fabio Panetta. It is now up to legislators to ensure it would replicate key characteristics of cash in the digital sphere, particularly its privacyhttps://t.co/nQJzYylwpV

1/3 pic.twitter.com/4XPlk83Lwj

— European Central Bank (@ecb) September 4, 2023Panetta supported the European Commission’s legislative proposals for the digital euro, stating that it would guarantee that Europeans always have access to a public payment option, whether currency or digital, even though“closed-loop solutions are becoming increasingly prevalent” in private payment services.