At the moment, the most heated debate in the crypto space is about crypto taxes amendments in the US Infrastructure Bill, CEO Elon Musk also has his take on the issue.

All eyes are on the Senate vote on Saturday, which could determine the future of cryptocurrency businesses in the United States.

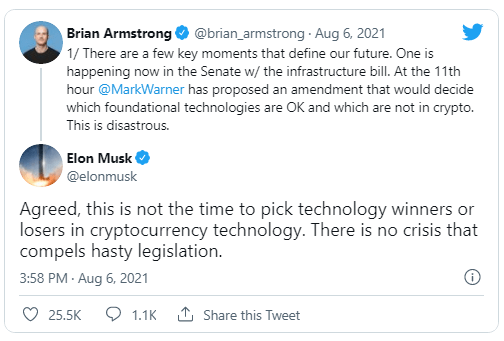

Elon Musk offers some sage advice for politicians at a time when the Biden administration has backed the contentious crypto amendment submitted at the last minute. “There is no urgency that demands fast legislation,” he says.

Musk said that the cryptocurrency ecosystem is still in its infancy and that now is not the time to pick winners and losers.

His remarks were made in reaction to Coinbase CEO Brian Armstrong’s tweet about a potential last-minute amendment proposal that could determine which crypto fundamental technologies are acceptable and which are not.

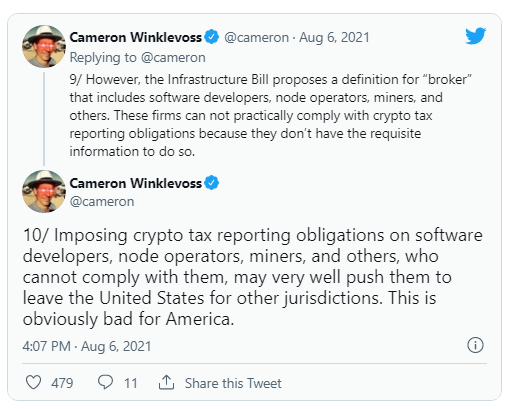

A crypto taxation provision in the US Infrastructure Bill, which is expected to cost over $1 trillion, would impose a $28 billion tax burden on the crypto economy. Once passed, the law would oblige crypto “Brokers” to submit their tax liabilities to the IRS.

The crypto community has objected to the bill’s definition of brokers, which includes software developers, node operators, miners, and a number of others.

Because they lack the necessary information, these businesses are unable to comply with crypto tax reporting duties.

Following multiple requests for revisions to the faulty bill, two amendment ideas are contending for inclusion in the bill.

Senators Ron Wyden, Cynthia Lummis, and Pat Toomey introduced the first plan on Wednesday, which is considered more inclusive because it exempts Bitcoin miners, wallet developers, crypto validators, and protocol developers from tax reporting.

Sens. Rob Portman and Mark Warner submitted a second plan at the last minute that solely exempts Proof-Of-Work validators and developers from the “impossible” tax reporting criteria.

The bill, however, has the support of the White House, and treasury secretary Janet Yellen is allegedly campaigning for it. Many feel that if it passes the Senate, it will drive Decentralized Finance (Defi) enterprises out of states.