Ethereum Name Service (ENS) has recorded impressive gains, but data shows the token has been overbought at this price point.

As of this writing, ENS is trading at $26.7, up 15.62% over the previous day. ENS has crossed the $26 threshold twice this month; the last time it did so was in January 2022.

Despite the recent price increase, ENS has dropped 69% from its peak of $85.69 in November 2021. After the price increase, ENS’s market capitalization increased to $840 million, ranking it as the 82nd-largest cryptocurrency.

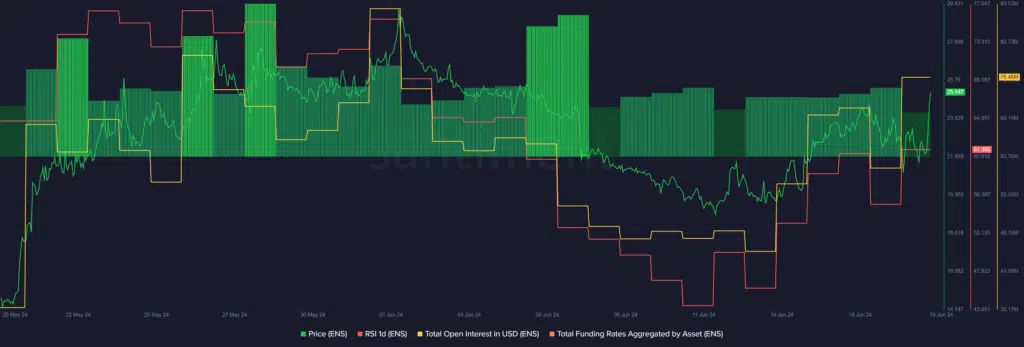

Additionally, the asset’s daily trading volume climbed by 39%, averaging $227 million. Sentiment’s data indicates that on the last day, the total open interest of the ENS rose by 27%, from $60.32 million to $76.45 million.

Because there are more liquidations following an abrupt spike in open interest, price volatility is typically higher. In the last 24 hours, the total financing rate aggregated by ENS fell from 0.009% to 0.006%, according to data from the market intelligence platform.

The data indicates that a rise in short positions, or traders betting on ENS’s price decline, is primarily responsible for the rising open interest. The ENS relative strength index (RSI), which is now hanging around 61, according to Santiment, indicates that the asset is marginally overbought and is susceptible to manipulation by big whales. The RSI of ENS would need to cool down below the 50 threshold in order for it to stay in the bullish zone.