Since The Merge, which was a big deal, people aren’t as interested in Ethereum as they used to be.

What took place?

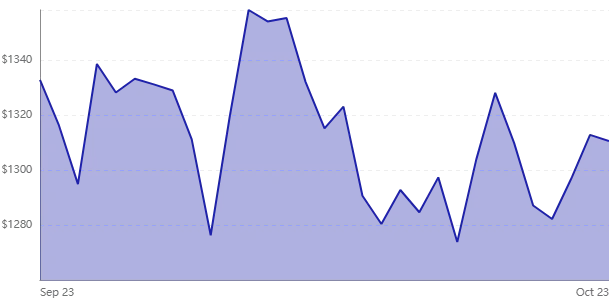

Overall, the crypto market has been much less volatile in the past few months than it has been for most of the past few years. Still, some of the most popular cryptocurrencies are moving today, and Ethereum (ETH 1.88%) is one of the biggest winners. As of noon ET, this top token had jumped 2.1% in the last 24 hours, likely because investors seem to be buying risky assets again, at least for now.

Even though the market is very unstable today, this big change shows that investors are becoming more interested in Ethereum’s improved network. Before Ethereum’s The Merge in the middle of September, which brought in a new proof-of-stake consensus mechanism that uses less energy, investors’ interest in Ethereum was at its highest point for the year. But since then, a mentality has grown that says, “Buy the rumor, sell the news.”

Still, Ethereum’s price has dropped about 35% since its high point in August. This may be a good time for value investors to buy this token as we head toward the end of the year. Whether it’s because of better macroeconomic conditions, a Santa Claus rally, or the hope that the crypto sector’s lower volatility will lead to higher prices in the medium term, it’s clear that expectations for this foundational blockchain remain high right now.

Then what

The switch from proof of work to proof of stake on Ethereum hasn’t been smooth. Many people praise the benefits of this huge upgrade, which mostly come in the form of a big drop in the amount of energy needed to run the network and the possibility of more upgrades and improvements in the future. However, there is growing debate about how centralized Ethereum’s network has become. Due to the high costs of setting up a validator node, aggregators and other centralized crypto entities have stepped up to do most of the staking, giving them control over the direction of the Ethereum network.

So, this upgrade, which sounded great in theory, has become a hot topic in the Ethereum community. Gas prices are still high, and it doesn’t look like much has changed at the core level. This is great in terms of how it works. But investors might want more significant changes sooner.

What now?

Now that this huge upgrade is done and didn’t cause too much trouble for Ethereum’s huge network, maybe more upgrades are on the way. Given how big this huge developer-led project is, it seems like anything is possible. In fact, it seems like a lot of the smartest and best people in the crypto space are committed to keeping the Ethereum network as the core of decentralized finance.

So, I think the market’s view of Ethereum may be shifting from this once-near-term catalyst to a more medium- to long-term view. Ethereum is a good choice for anyone looking for quality in the crypto space. Maybe that’s all there is to today’s rally: a shift toward safer and more stable options in different asset classes.