Ethereum sees a surge in active addresses and legal activity, drawing attention to its valuation as it battles key resistance levels.

Ethereum (ETH) is experiencing an increase in activity on its network and in the legal sector. In the midst of these developments, Ethereum’s valuation is a topic of interest, as the decentralized finance (DeFi) asset continues to confront significant resistance levels.

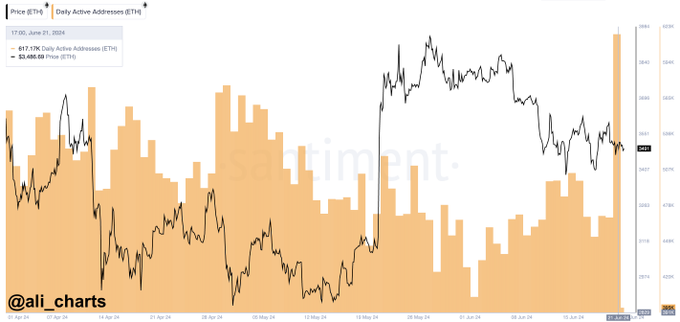

In an X post on June 22, crypto analyst Ali Martinez reported that the network has experienced a significant increase in active addresses in recent developments.

The data indicates that Ethereum experienced its most significant increase in active ETH addresses in the past three months, with a total of 617,170. This increase in activity indicates that there is a growing interest and engagement with the Ethereum blockchain, which could potentially influence its price trajectory.

The rise in active addresses could be interpreted as a reflection of the platform’s increasing confidence and network usage. In the past, price rallies have frequently been preceded by such increases in active addresses, as increased activity can suggest higher transaction volumes and more utility.

Ethereum is also experiencing an increase in other metrics, in addition to the increase in active addresses. Ethereum’s Market Value to Realized Value (MVRV) indicator is increasing at a quicker pace than Bitcoin’s (BTC) MVRV, as indicated by data from crypto analytics platform CryptoQuant.

MVRV is the ratio of a digital asset’s market capitalization to its realized capitalization. It is implemented to evaluate whether the token is overvalued or undervalued.

The increase in user activity is aligned with the general sentiment of the crypto market, as Ethereum is largely subdued during this period. CoinCodex, a platform that employs AI-driven machine learning algorithms, has provided a short-term prediction of Ethereum’s price.

ETH is expected to trade at $3,552 by July 1, 2024, according to data obtained from the platform on June 23. The forecast indicates a slight increase in price of 1.6%.

Ethereum continues to be the subject of attention following the Securities and Exchange Commission’s (SEC) decision to conclude its “Ethereum 2.0” investigation of ConsenSys. The SEC’s enforcement division informed ConsenSys that it was concluding its investigation into Ethereum 2.0. The SEC stated that it “would not bring charges alleging that sales of ETH are securities transactions.”