Ethena Labs has partnered with Securitize, a tokenization platform, to jointly submit a proposal to include Ethena’s USDtb stablecoin in Spark’s $1 billion Tokenization Grand Prix.

The competition aims to provide liquidity to selected participants to onboard real-world assets (RWAs) to decentralized finance.

The proposal includes implementing an exchange facility for USDtb and USDe, two of Ethena’s stablecoins.

This feature would allow the Sky ecosystem to manage and reallocate between the two stablecoins in response to market conditions or interest rate changes.

According to sources, experts, including Phoenix Labs and Steakhouse Financial, will assess applications based on competitive pricing, liquidity, and alignment with Spark’s strategic objectives. Sky tokenholders will conduct a governance referendum to determine the final selections.

Ethena asserts that it presently contributes nearly $120 million in annual revenue to the Sky ecosystem, previously known as MakerDAO.

Alternative Risk Profile

USDtb, scheduled to debut next week, is supported by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

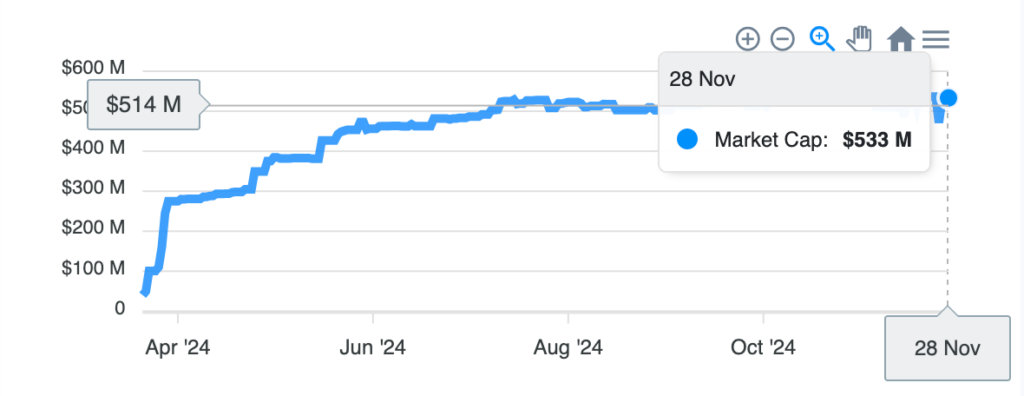

This tokenized US Treasury fund was established on the Ethereum blockchain in March 2024 and presently owns over $533 million in tokenized assets.

The risk profile of Ethena’s forthcoming stablecoin will differ from that of its current synthetic dollar, USDe, which employs derivative hedging strategies involving various cryptocurrencies, rendering it more susceptible to market fluctuations.

Ethena Labs has suggested that the integration of UStb could improve the efficacy of its synthetic dollar during periods of weak funding conditions.

In particular, USDe’s supporting composition can be dynamically adjusted to include USDtb to mitigate the risks associated with negative funding rates.

As of November 29, the market value of Ethena’s USDe has exceeded $4.3 billion, according to CoinGecko data.

CCData’s most recent analysis indicates its performance is due to “the increased interest in the Ethena ecosystem following its proposal to activate revenue share for Ethena (ENA) token holders.”