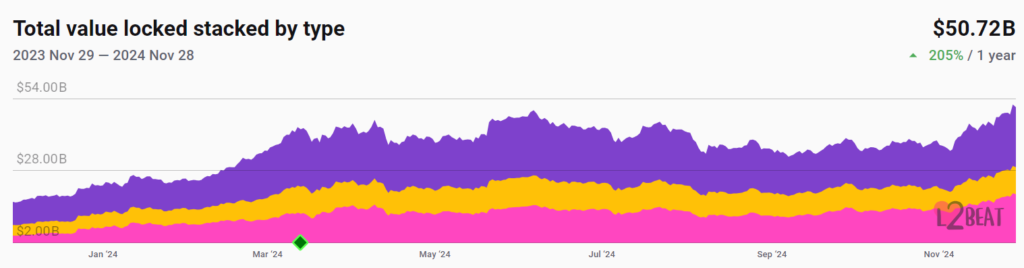

The cumulative total value locked (TVL) of Ethereum layer-2 (L2) networks has attained a new all-time high of over $51.5 billion, indicating investors’ growing interest in the Ethereum ecosystem.

This is a significant increase in cumulative TVL, which has risen from $16.6 billion in November 2023 to over 205%, according to L2beat data.

To enhance the scalability of Ethereum, the foremost smart contract network, it is imperative to implement L2 scaling solutions.

The L2s reduce the overall cost and waiting time associated with the Ethereum mainnet by offloading and processing transactions on secondary chains.

Some industry experts are apprehensive that L2s are “cannibalistic” for the Ethereum mainnet’s revenue and may erode Ether’s price potential despite their substantial benefits.

Arbitrum One and Base generate a 205% increase in L2 value

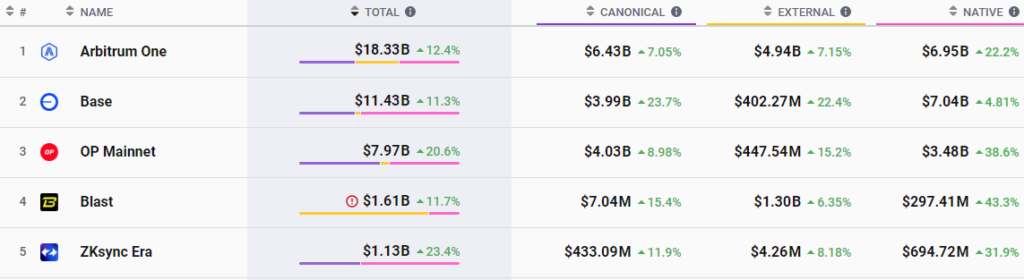

Arbitrum One and Base were the primary factors contributing to the increase of more than $51 billion in TVL.

Arbitrum is the dominant L2 and possesses over $18.3 billion in TVL, which accounts for 35% of the total TVL in the L2 ecosystem.

Base, the second-largest L2 network, has $11.4 billion in TVL, which accounts for just over 22% of the cumulative L2 TVL.

Base’s TVL increased by over 11.4%, while Arbitrum’s TVL increased by over 12% in the week preceding Nov. 28.

On Nov. 26, Base’s transaction volume (TVL) surpassed the $10 billion milestone for the first time, surpassing the previous record of 106 transactions per second (TPS). The memecoin fervor during this bull cycle is the primary reason for the recent passage of the 1 billion milestone in the total number of Base transactions.

Dencun upgrade -a significant milestone in stabilization of L2 fees

Ethereum’s Dencun upgrade, which was shipped in March, has substantially increased L2s, the largest network upgrade since the Merge.

Nick Dodson, the co-founder and CEO of Fuel Labs, stated to Cointelegraph that it significantly assisted in the stabilization of fees associated with L2s.

“On the point of EIP-4844, a lot of people talk about the fee reduction, but it’s more about fee stabilization. It’s actually more about expanding capacity and scale and not so much lowering fees.”

The upgrade resulted in a 99% median transaction fee reduction for certain Ethereum L2s, such as the mainnets of Starknet, Optimism, Base, and Zora OP.