DeFi Report founder Michael Nadeau outlined that most Ethereum value moved to layer 2s, which would drive value to the layer-1 blockchain.

While Solana has received inflows from other blockchains, a significant portion of that value has flowed back to Ethereum, according to Michael Nadeau, founder of The DeFi Report.

In an X post, Nadeau stated that Solana must attract total value locked (TVL) from Ethereum and layer-2 networks, explaining:

“[…] But the only thing that really matters for Solana is pulling TVL from Ethereum (and the L2s). Why? That’s where all the value sits today. Is it happening? Not really.”

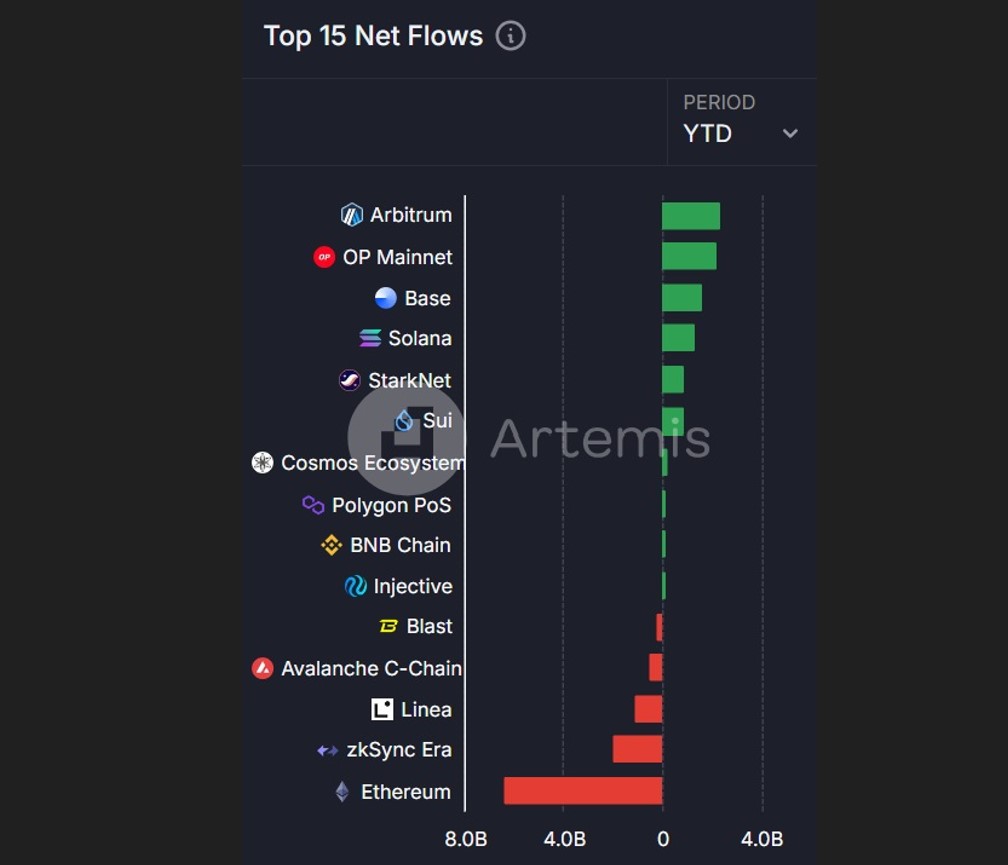

Drawing on data from crypto platform Artemis, Nadeau noted that year-to-date (YTD), Solana has lost around $55 million in TVL to Base, Optimism, and Arbitrum.

Over $1 Billion Returned to Ethereum

Nadeau reported that Solana saw $2.36 billion in inflows from Ethereum on its YTD chart; however, over $1 billion flowed back to Ethereum, amounting to 42% of the total.

He further commented that the inflows to Solana from Ethereum YTD were “modest,” contributing just 2.7% to Solana’s TVL.

According to DefiLlama, Ethereum currently holds over $50 billion in TVL.

Nadeau added that, although Ethereum has seen $6 billion in net outflows YTD, 83% of these assets went to layer-2 chains within its ecosystem, which continue to support Ethereum’s layer 1 by retaining value within the ecosystem.

Solana Outpaces Ethereum in Daily Fees

On Oct. 28, Solana surpassed Ethereum in daily fees, generating more than $2.54 million within 24 hours, compared to Ethereum’s $2.07 million.

This achievement made Solana the fifth-largest fee-generating protocol that day.

The increase in Solana’s fees was attributed to rising activity on Raydium, a decentralized exchange (DEX) and automated market maker on the Solana network.