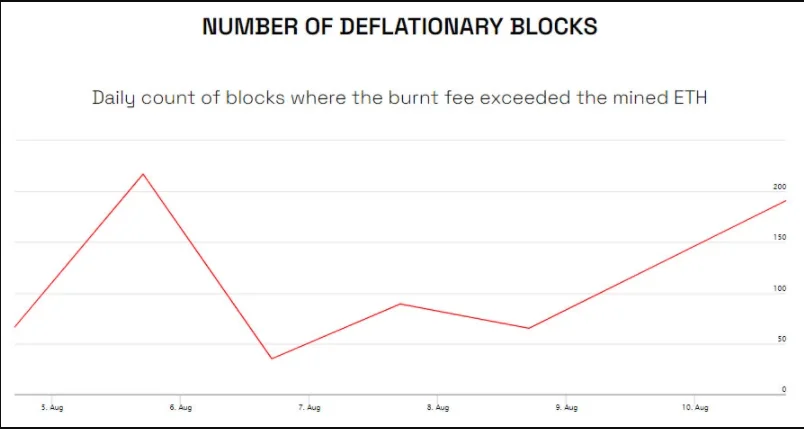

So far, a surge in gas fees and Ethereum burn rates has resulted in the creation of nearly 800 deflationary blocks.

Since Ethereum’s London update last week, its potential deflationary features have already been demonstrated in operation on the blockchain, with around 800 “deflationary blocks” having been generated so far.

A surge in the Ethereum transaction fee burn rate has resulted in at least two hours of deflationary supply due to an increase in the transaction fee burn rate. A significant amount of gas has been burned as a result of the high demand placed on the network during the past several days.

The ‘ETH Burn Bot’ documented an occurrence when 545 Ethereum was burned in one hour, which occurred around four hours ago (as of 22.00 UTC). In this case, the issuance of Ethereum was stated to be 532 Ethereum per hour, resulting in an asset deflation of minus 13 Ethereum for that brief period of time.

In the following several hours, the Ethereum Burn Bot spotted an even greater deflationary burn that resulted in the burning of 945 tokens within an hour, leading to the creation of an unexpected brief negative issuer of -417 Ethereum. This was calculated to be a deflation rate of -3.12 percent on an annualised basis.

945.1184 $ETH burned last hour.

Issuance: 528.0000 ETH

Net Change: -417.1184 ETH

Annualized: -3.12%

2021-08-10 22:00-23:00 UTC

Last Block: 13000300

Cumulative : 24,942.1282 ETH

— ETH Burn Bot (@ethburnbot) August 10, 2021It is possible to construct deflationary blocks and so temporarily reduce the supply of ETH if the amount of ETH burned exceeds the mining reward.

This has been spotted on a tracker maintained by advising firm Carbono, which currently reports that there have been 791 deflationary blocks so far, which it defines as blocks in which the burned fee has exceeded the amount of ETH mined so far.

As a result of the London hard fork’s deployment on August 5, the much-anticipated EIP-1559 upgrade, which made adjustments to the transaction fee calculation method, was made available. As part of that modification, a mechanism was implemented that causes a percentage of the base fees collected to be burned.

According to ultrasound.money, which keeps track of the amount of ETH that has been burned as of the time of writing, 25,600 ETH has been burned. This corresponds to approximately $80 million in just under a week’s time at present rates.

When the fee burning is paired with the drop in block reward issuance that will occur as a result of the transition to proof-of-stake at some point in 2022, the Ethereum economy will not be expected to experience lasting deflation.

However, the news is not all good for Ethereum users, as gas costs have risen once more in recent weeks. According to Bitinfocharts, the average transaction price has risen to $20 from a low of roughly $4 in late July to a high of $20 today. The gas tracker on Etherscan is showing that a token swap on Uniswap can cost as much as $28.60.

Because of this, NFTs have been driving up demand for Ethereum blockspace. The OpenSea marketplace, Gala Games’ Vox, and Axie Infinity are three of the top four gas consumers, with a combined total of 2,200 ETH, or $7 million, consumed thus far.