In a single day, Ethereum whales have traded the highest volume of ETH since January.

Despite widespread losses across the cryptocurrency market, Ethereum whales have been buying and selling Ether (ETH) at a rate not seen since January of this year.

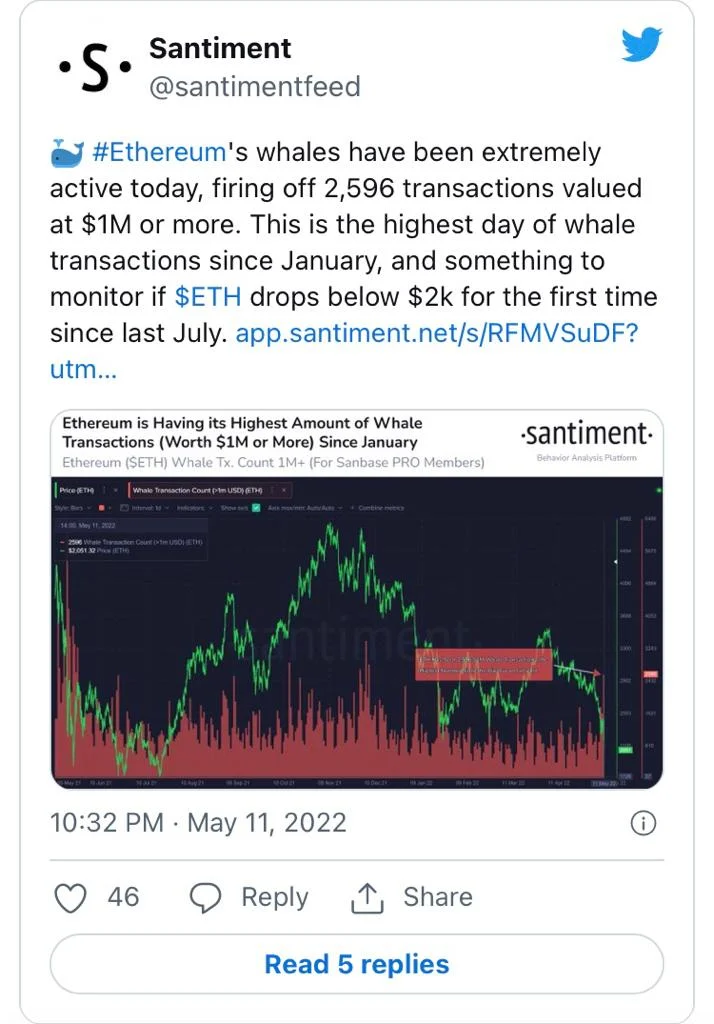

According to Santiment data, Ethereum whales made a total of 2,956 transactions worth more than $1 million on Wednesday, the highest day of whale transactions in nearly 5 months. Santiment

clarified that whales are typically

defined as any account with a balance of $1 million to $10 million.

The data comes as the ETH/BTC pair maintains its relative strength, despite the Terra-based contagion that continues to weigh on the market and general sentiment.

ETH/BTC reached a three-week high earlier this week on May 6, according to market analysis, and the paring is hinting at a potential breakout, particularly as both Bitcoin (BTC) and Ether approach what Santiment has called their “historic buy zones.”

Notably, Ethereum has increased by nearly 250 percent against Bitcoin since the Beacon Chain went live, kicking off the transition to proof-of-stake in December 2020.

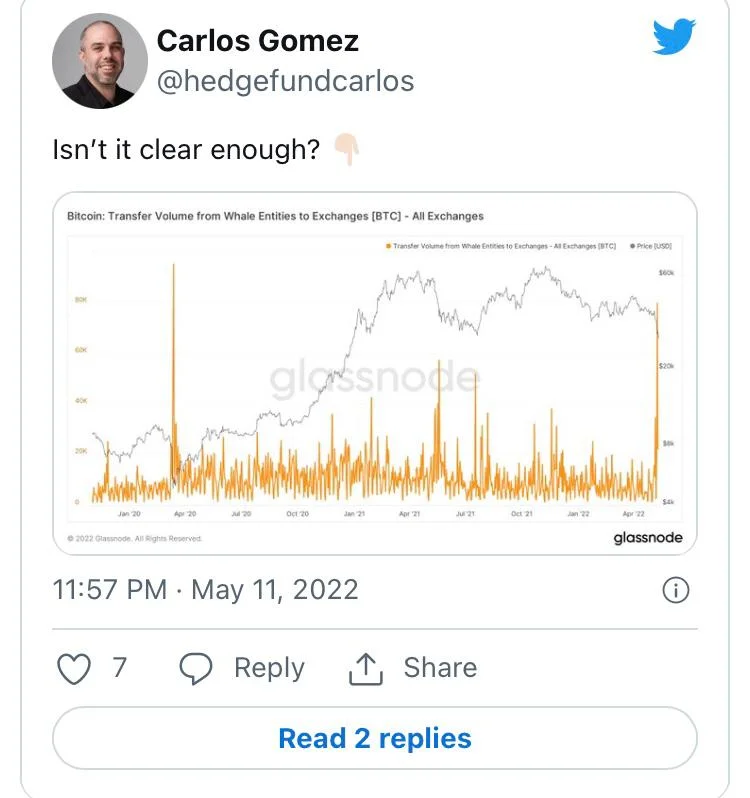

Not only have Ethereum whales been active; but according to Glassnode data, Wednesday saw the largest one-day transfer of Bitcoin from Whale Entities to exchanges.

Carlos Gomez, Chief Investment Officer at Belobaba crypto hedge fund, on his reaction said that this type of market activity may indicate that crypto investors are closer to the bottom of the current market dip than they realize.

According to Gomez, the graph above shows a “clearly coordinated movement of most of the large holders in a specific 24-hour-window,” implying that whales are still looking for weak hands.

Gomez went on to say that it’s difficult to say whether the bottom has been reached, but that “recent evidence shows that we’re not too far from it — the only thing is, we may have to live down here at these levels for a few weeks before going up again.”