Due to the decrease in ETH supply and the EIP 1559 burning mechanism, the price of Ethereum (ETH) is expected to be deflationary after the Merge.

After the Merge, more Ethereum (ETH) will be issued only if more validators join the pool, according to data from Glassnode.

In this sense, validators will have a significant impact on whether Ethereum’s price deflates or increases.

After the merge, Ethereum’s price rises

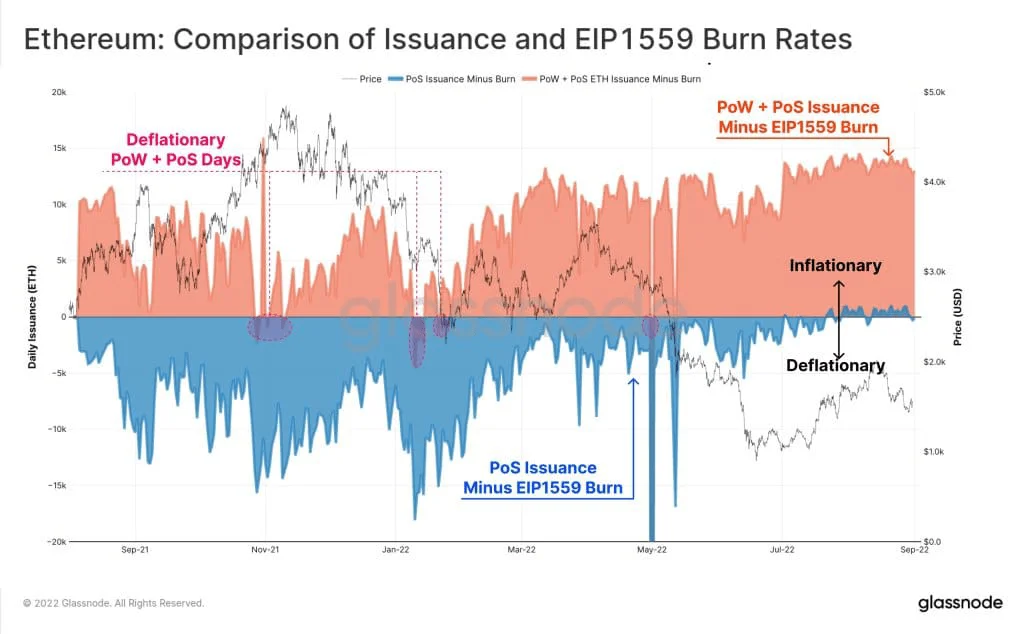

According to Glassnode’s simulation of Merge in August 2021, Ethereum (ETH) issuance can depend on a set of chains that decides its deflationary or inflationary nature.

On the PoW + PoS chains, with the EIP 1559 burn mechanism, Ethereum issuance will be inflationary. Thus, the price will increase.

However, on PoS with EIP 1559 burning mechanism, the Ethereum (ETH) issuance will be deflationary. Hence, the price will decrease.

It suggests that chains, rather than the EIP 1559 burning mechanism, will determine whether the price of goods and services increases or decreases after the Merge.

The inflation or deflation of ETH is determined by the ratio of the issuance rate to the burning rate.

With the EIP 1559 burning mechanism implemented in the simulated PoS chain, the issuance of Ethereum (ETH) will have a deflationary effect.

There is a risk that the deflationary effects of the increase in gas prices following Merge will reduce the amount of ETH available.

The gas costs themselves are unaffected by the Merge, but they will have an effect on the price of Ethereum (ETH) after it. The supply of ETH will fall in response to a rise in gas fees, which might have a significant effect on the price.

Additionally, the number of validators is expected to rise during the Merge.

The switch to PoS will also make it easier for users to migrate to roles as non-block-producing nodes, which eliminates the need for them to stake ETH.

Beacon Chain’s issuance of ETH grows in proportion to the size of a pool of validators. It is useful for calming the nerves of investors worried about technical dangers.

After the Merge, however, validator outputs decrease.

ETH might fall

Over the past 24 hours, the price of Ethereum (ETH) has risen above the $1550 mark.

However, the Merge, in addition to the current market conditions, is likely to drive the price down.

While a drop to $1,000 is possible for ETH, it won’t happen right after the Merge. Until the Shanghai upgrade is implemented, the staked Ethereum will be inaccessible.

In addition, the Merge’s final pricing won’t be determined for another 6-8 months.