Europe and Canada already have billions of dollars worth of spot and futures Ethereum-related products, while U.S. regulators are still debating spot Ethereum ETFs.

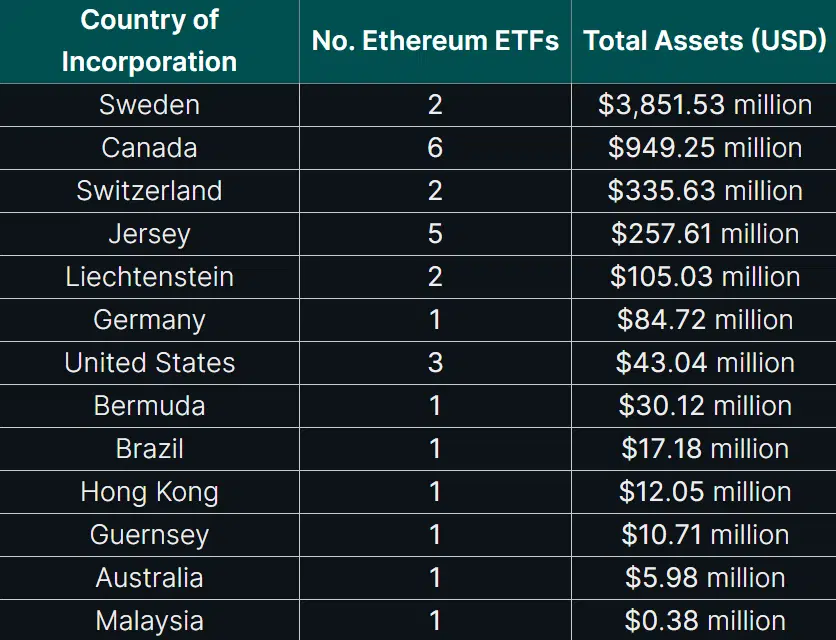

Europe has an 81.4% market share in the worldwide Ethereum (ETH) ETF market, according to a Coingecko report. There are thirteen ETFs in the space with ETH backing, distributed among futures funds and spot products, with a total of $4.6 billion in assets under management (AUM).

Canada is another significant market with 16.6% of the market share and $949 million in AUM for ETH ETFs. For many Canadian investors, ETFs have also become a means of entry into cryptocurrency.

Local authorities tightened their regulations on cryptocurrency businesses, which caused exchanges like Binance and Bitstamp to leave the market. The total assets under management (AUM) of the global ETH ETF, which includes both spot and futures funds, was $5.7 billion as of February 2.

Grayscale introduced its ETH trust (ETHE) in 2017, and since then, European Ethereum ETFs have been trading. However, Grayscale’s fund was not included in the analysis because of its closed-ended nature.

The company was discussing with the U.S. Securities and Exchange Commission (SEC) about transforming ETHE into a spot Ethereum ETF, but a decision was not made until May.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) were approved in the United States, but SEC head Gary Gensler emphasized that Ethereum-based products might not be given the same consideration.

Gensler has stated time and time again that the majority of cryptocurrencies are securities and need to be registered with the SEC. However, the SEC’s legal defeat against Grayscale and the ultimate approval of spot BTC ETFs on January 10 may increase the likelihood that spot ETH funds will be approved.

The SEC was deemed to have been “arbitrary and capricious” in its refusal to authorize spot cryptocurrency products while permitting futures-based exchange-traded funds (ETFs).

Hester Peirce, a commissioner of the SEC, added that Ethereum ETF approvals will differ from their Bitcoin equivalent, where a court order was necessary to persuade the securities watchdog to reconsider its decision.

Until the second quarter of 2024, several spot ETH ETFs, including proposals from issuers including Fidelity and Invesco Galaxy, have been postponed.