The Extreme Fear and Greed Index showed that investors are extremely fearful of Ethereum, as ETH recorded its lowest price in 14 months

Extreme Fear Among Ethereum Investors

Ethereum may still be in second place behind Bitcoin, but the trends for this altcoin do not appear to be encouraging.

The Ethereum needle, with a score of 23, is in the Extreme Fear segment of the gauge, according to the Extreme Fear and Greed Index.

According to CoinGecko, ETH is presently ranked second with a total market worth of $228,139,949,517. This puts ETH behind BTC but ahead of USDT.

Ethereum Price Lowest In 14 Months

Notably, ETH’s price has increased by 6.1 percent in the last 24 hours. When looking at weekly figures, though, ETH is down 7.5 percent.

Worse, the monthly loss is a heartbreaking 32.8 percent. It’s at its lowest point in 14 months.

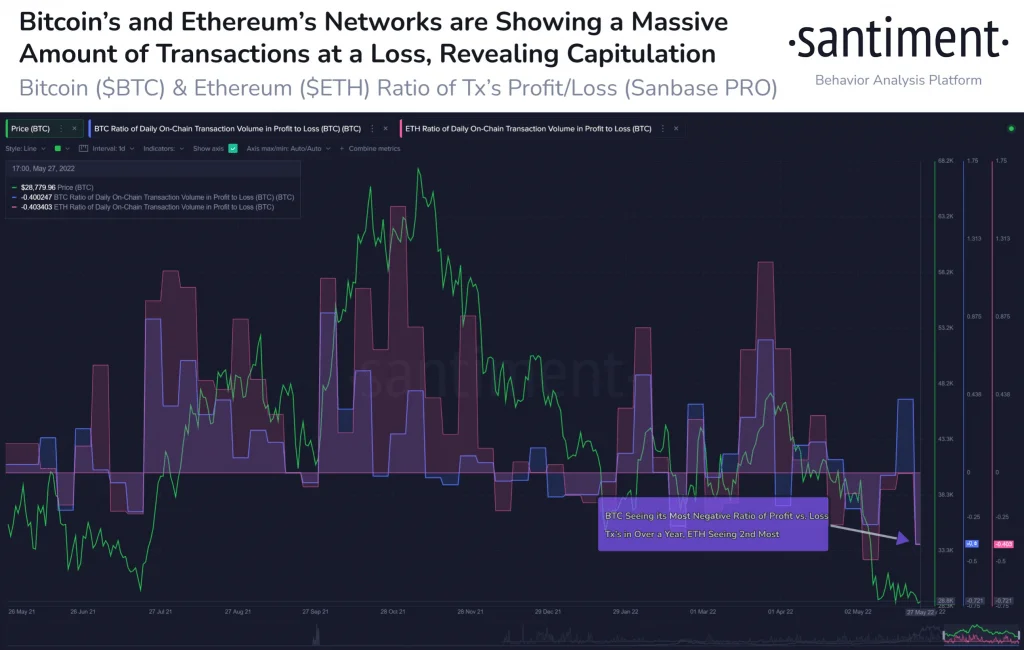

In a similar issue, a market data company Santiment tweeted last week that Ethereum’s profit-to-loss transaction ratio was “dramatically low” during the weekend. Analysts believe this is one of the reasons for its low price.

Another concerning trend is the drop in daily active addresses, which has dropped from 650,000 to 450,000 in the last year.

ETH has also experienced a trading volume of $12,118,486,311 in the last 24 hours. ETH is presently trading at $1,901 at the time of writing.

To put things in perspective, Ethereum’s all-time high was $4,878.26 in November of 2021.

Nonetheless, the popular coin’s future does not appear to be grim. The Merge is a huge update that users are looking forward to.

This is the time when the Ethereum mainnet and the beacon chain proof-of-stake system will converge.