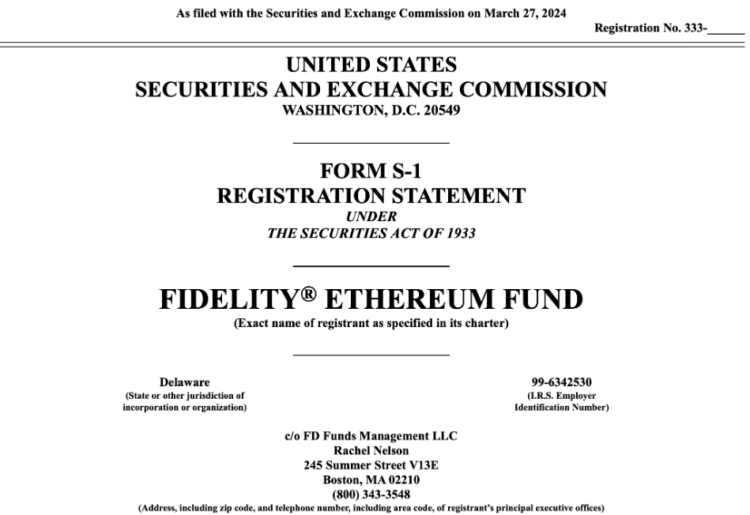

On March 27, Fidelity submitted an S-1 application to the US Securities and Exchange Commission (SEC) to establish a spot Ether exchange-traded fund (ETF).

The Cboe BZX Exchange would facilitate trading of the asset management behemoth’s ETF. Affiliated with sponsor FD Funds Management, Fidelity Digital Asset Services would be responsible for the custodianship of the trust’s ETH. As stated in the S-1:

The Trust [fund] intends to establish a program to stake a portion of the Trust’s assets through one or more staking infrastructure providers.

To stake a fraction of its assets via one or more staking infrastructure providers, the Trust [fund] plans to implement a program for this purpose.

This decision involves further risk, according to the application.

Liquidity risks and the possibility of loss (including “slashing” penalties) would exist during the processing of the stake. Additionally, for tax purposes, staking rewards would be considered income for the fund; consequently, investors would incur a taxable expense “without an associated distribution from the Trust.”

There is no mention of anticipated ETF fees in the application. The custodian will determine which chain the fund will support in the event of a bifurcation.

Multiple additional risks are affiliated with the ETF. The form highlights the potential adverse effects of regulatory measures on the fund in the United States and other jurisdictions.

It lists regulatory actions such as the SEC classifying the fund as an investment company under the 1940 Act, the U.S. Commodity Futures Trading Commission classifying the fund as a commodity pool under the Commodity Exchange Act, and the U.S. Treasury Department’s Financial Crimes Enforcement Network classifying the fund as a money service business as among the potential causes of the trust’s termination.

According to analysts, the SEC’s alleged investigation of the Ethereum Foundation could affect the likelihood of spot ETH ETF approval. Additionally, political opposition to identifying ETH EFTs has existed.

A 51% assault is another vulnerability of the Ethereum blockchain, in which a malicious actor could seize control of the network using a majority vote. The form states, “Nearly fifty percent of the ether staked on the Ethereum network was under the control of the three largest staking pools.” Lido DAO holds 31.5% of all staked ETH, making it the largest ETH staking pool.

The implementation of a spot ETH ETF, according to analysts, could potentially mitigate the impact of DAOs but introduce a new “concentration risk” contingent on how ETFs allocate their ETH to stakeholders.

The SEC has extended until May 23 the deadline for the certification of additional ETH ETFs. Eight nominations for spot ETH EFTs are currently pending a decision from the SEC.