FTX debtors are in talks with finserv firm Perella Weinberg Partners for various sale or reorganization attempts.

However, the engagement of PWP is subject to the bankruptcy court’s approval. The defunct cryptocurrency exchange FTX and 101 of the 130 affiliated companies announced the beginning of a strategic review of their global assets as part of the most recent bankruptcy filing. In order to maximize recoverable value for stakeholders, the review will be conducted.

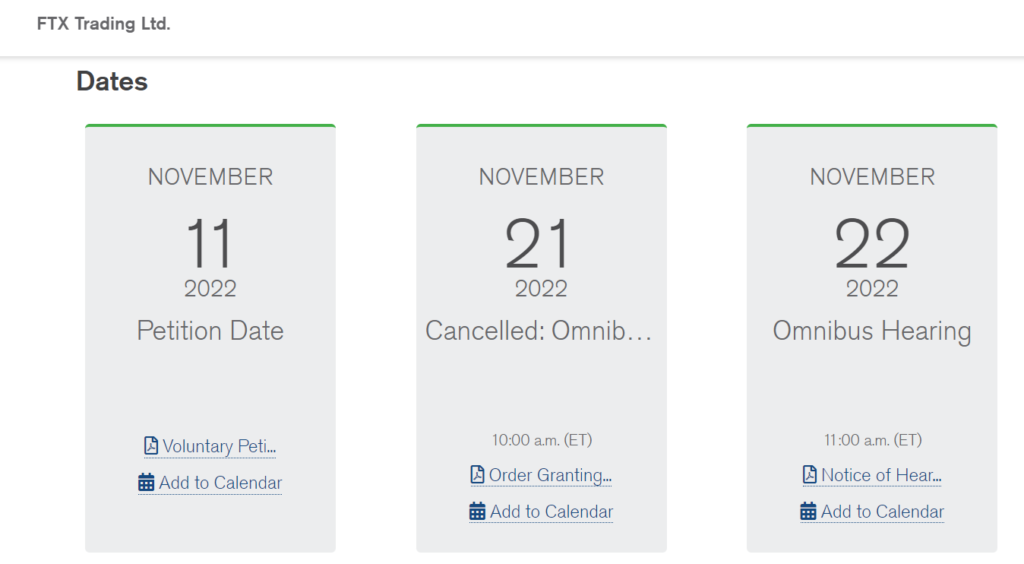

After being discovered stealing user funds, the crypto exchange, which was then headed by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on November 11. The bankruptcy filing aimed to mitigate losses for FTX debtors—parties with ties to FTX and associated businesses.

FTX debtors are in talks with financial services firm Perella Weinberg Partners for various sale or reorganization attempts. However, the crypto exchange cautioned that “the engagement of PWP is subject to court approval.”

SBF’s replacement, CEO John J. Ray III, confirmed that FTX affiliates have solvent balance sheets, which could be sold or restructured to cut losses. While highlighting that some subsidiaries, such as crypto exchange LedgerX, are exempted as debtors in the bankruptcy filing, he added:

“Either way, it will be a priority of ours in the coming weeks to explore sales, recapitalizations or other strategic transactions with respect to these subsidiaries and others that we identify as our work continues.”

Additionally, debtors have concurrently submitted motions to the bankruptcy court asking for temporary relief; these motions are scheduled to be heard on November 22, 2022. Ray asked all parties involved to “be patient” despite the fact that no deadline for the sale or restructuring had been established.

On November 19, the legal team assisting FTX and SBF during bankruptcy withdrew from the case, citing conflicts of interest.Martin Flumenbaum, an attorney for Paul, Weiss:

“We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, that conflicts have arisen that precluded us from representing him.”

Flumenbaum believed that Sam Bankman-Fried’s “incessant and disruptive tweeting” negatively impacted the reorganization efforts of the lawyers.