FTX’s bankruptcy estate settled with Bybit on October 24 to resolve a 2023 lawsuit seeking funds to repay clients and creditors.

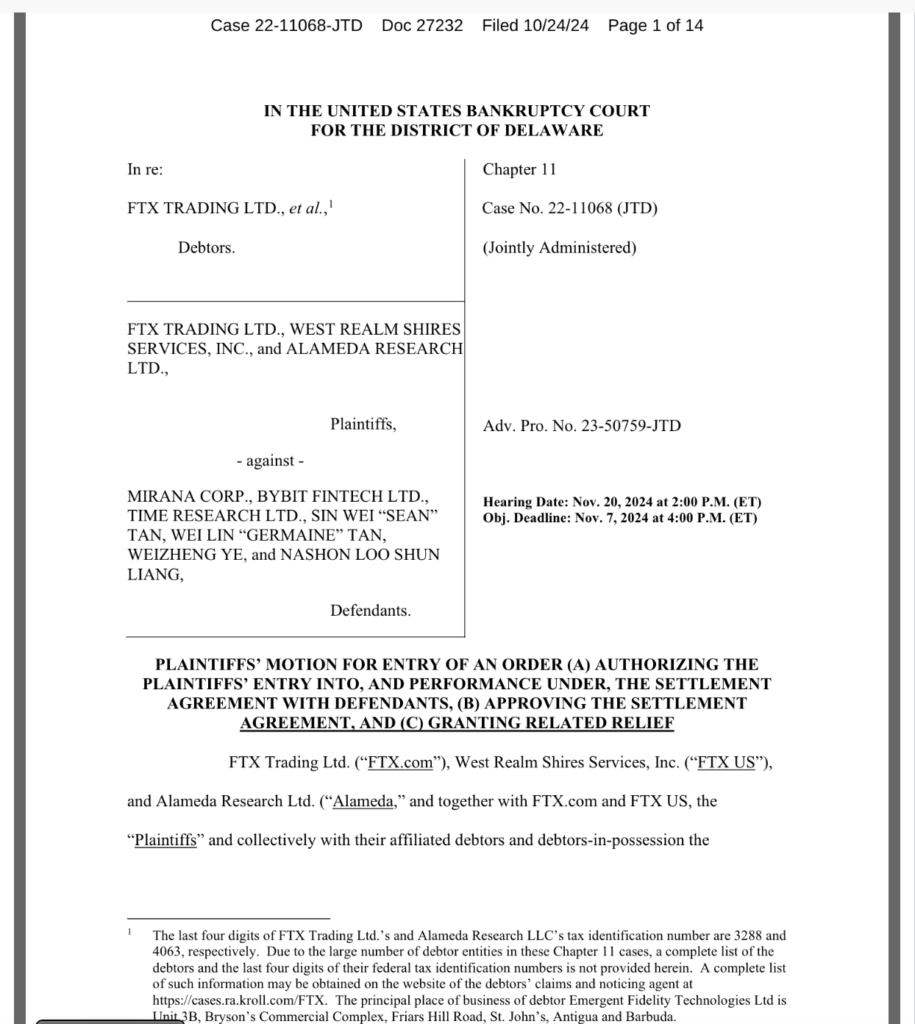

The FTX bankruptcy estate reached an agreement with the Bybit exchange in a legal document on October 24 to settle a lawsuit it initially launched in 2023. The FTX estate brought the case to recover funds to compensate former clients and creditors.

As stated in the legal document, the settlement agreement will make it possible for FTX to sell about $53 million worth of BIT tokens to Mirana Corp., which is an investment branch of the Bybit exchange.

Additionally, Bybit will allow FTX to withdraw $175 million worth of digital assets. The attorneys for FTX pointed out that even though their allegations have some validity, continuing the litigation would be a burdensome process.

“Plaintiffs’ claims for turnover, violations of the automatic stay, and fraudulent and preferential transfers are disputed, carry some degree of risk, and in any event would be time-consuming and expensive to further litigate.”

A court still needs to approve the settlement agreement, and the two sides have scheduled a hearing to ratify it for November 20, 2024, at 2:00 p.m. Eastern time. They initially filed the lawsuit against Bybit and Mirana in November 2023, alleging that the entities used “VIP” access and a close relationship with FTX executives to preemptively withdraw approximately $327 million in digital assets and cash immediately prior to the final collapse of it.

FTX initially filed the lawsuit for a total of one billion dollars. The FTX bankruptcy estate’s attorneys claimed that the team granted priority withdrawal privileges to Mirana and other individuals during the early stages of the collapse.

A database recorded these privileges.In the course of the lengthy bankruptcy processes that lasted for years, the FTX estate and the legal counsel for the former exchange were required to navigate a number of legal challenges, including the litigation that occurred against Bybit.

After Judge John Dorsey gave his approval to the restructuring plan for FTX on October 7, 2024, investors decided to voluntarily abandon their case against Sullivan & Cromwell, the law firm that had represented it in a number of transactions while the business was still in operation.

A group of companies that owed money to FTX accused the law firm of knowing about and participating in the FTX scam while simultaneously reaping financial benefits from continuing to serve as legal counsel for the corporation.