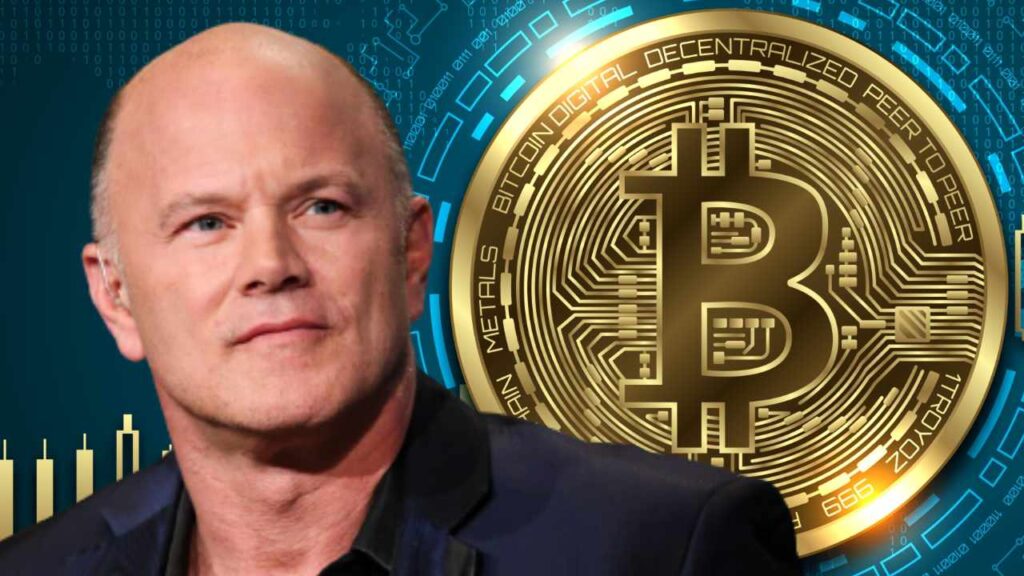

Galaxy CEO Mike Novogratz commented on rumors of China lifting its crypto ban, highlighting the potential global impact.

In a recent X post, Galaxy CEO Mike Novogratz expressed his opinions on China’s prospective modification of its Bitcoin policy. Notably, there are recent rumors that suggest China may be considering the possibility of lifting its prohibition on cryptocurrencies, which could significantly alter the global market.

In the interim, Novogratz’s response emphasizes the substantial influence such an action could have on the cryptocurrency industry.

China’s experience with cryptocurrencies has been turbulent. In 2013, the government prohibited financial institutions from engaging in Bitcoin transactions. Notably, this signified the commencement of rigorous regulations that were designed to restrict the activities of cryptocurrency.

In 2017, China implemented a more stringent policy by prohibiting Initial Coin Offerings (ICOs) and closing domestic exchanges. The final strike was delivered in 2021 with the prohibition of all transactions related to crypto mining.

Nevertheless, the demand for cryptocurrencies in China persisted despite these constraints. The development has been praised by enthusiasts such as Galaxy CEO, as individuals have resorted to clandestine markets and overseas exchanges to trade and acquire digital coins.

The persistent interest underscores the potential impact of China lifting its ban. In the interim, there have been recent reports that Bitcoin may be permitted in China by the fourth quarter of 2024.

This potential policy change has the potential to have a substantial impact on the global market. China’s re-entry into the cryptocurrency market could potentially increase trading volumes and prices, as it is one of the largest economies.

It is also important to note that China may utilize its technological expertise to advance blockchain applications during the innovation wave.

Galaxy CEO Mike Novogratz conveyed his enthusiasm in response to these rumors. He underscored the significance of such an action, asserting that it would be a “significant development” for the cryptocurrency sector. Novogratz’s statements are indicative of the general sentiment within the cryptocurrency community.

A positive change in China’s posture could result in significant benefits but also introduce new regulatory challenges. Furthermore, the prospective policy reversal by China could represent a significant turning point.

It may stimulate the crypto market and signifie a more widespread acceptance of digital currencies. The world is acutely aware of the profound implications as these developments transpire, and it is closely monitoring them.