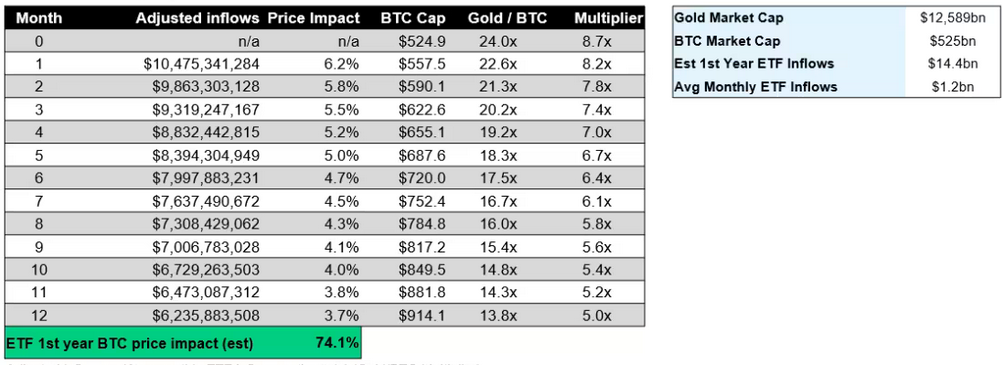

At this point, a 74% increase brings Bitcoin to well over $59,000, which does not include “second-order effects,” according to Galaxy Digital.

According to Galaxy Digital, the price of Bitcoin will increase by 74.1% in the first year following the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States.

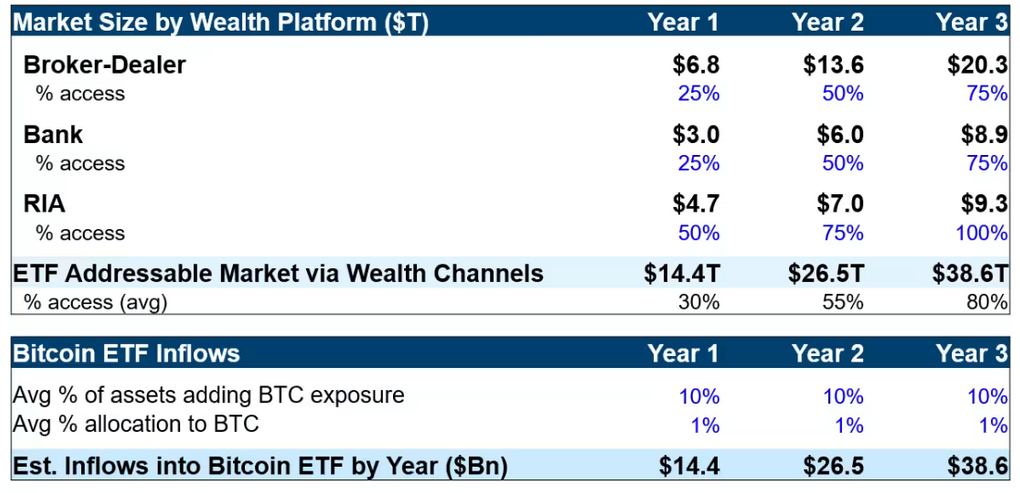

Charles Yu, a research associate at Galaxy Digital, estimated in a blog post published on Oct. 24 that the total addressable market size for Bitcoin ETFs in the first year after commencement would be $14.4 trillion.

The 74% figure was determined by evaluating the prospective price impact of fund inflows into Bitcoin ETF products using gold ETFs as a baseline.

According to Yu’s estimates, Bitcoin’s price would increase by 6.2% in the first month following the introduction of an ETF before gradually decreasing to a 3.7% monthly increase by the twelfth month.

Yu utilized Bitcoin price data from Sept. 30; however, a 74.1% increase in Bitcoin’s current price would result in a price of $59,200.

If BlackRock’s spot Bitcoin ETF application is approved, Markus Thielen, director of research at digital asset financial services firm Matrixport, estimated in an Oct. 19 post that Bitcoin could rise to between $42,000 and $56,000.

Yu forecasts that the addressable market size for U.S. Bitcoin ETFs will reach $26.5 trillion in the second year after commencement and $39.9 trillion in the third year.

Yu acknowledged that delaying or denying Bitcoin spot ETFs would affect the price forecast.

Nevertheless, he stated that the estimates were still conservative and did not account for “second-order effects” from the approval of spot Bitcoin ETF.

“In the near-term, we expect other global/international markets to follow the U.S. in approving + offering similar Bitcoin ETF offerings to a wider population of investors,” Yu wrote.

He added, “2024 could be a big year for Bitcoin,” citing ETF inflows, the April 2024 Bitcoin halving, and “the possibility that rates have peaked or will peak in the near term.”